ZigZag Close Indicator for MT4 – Clear Market Structure & Swing Analysis Tool

The forex market rarely moves in a straight line. Even within a strong uptrend or downtrend, Price Action forms waves — creating peaks, troughs, pullbacks, and impulses. Identifying meaningful price structure amid this constant fluctuation can be challenging.

The ZigZag Close Indicator for MetaTrader 4 simplifies this process by filtering out minor market noise and highlighting significant swing highs and lows based on closing prices. This provides traders with a clearer view of true price progression from one major turning point to another.

What Makes the ZigZag Close Indicator Unique?

Unlike standard ZigZag indicators that rely on highs and lows, the ZigZag Close indicator calculates swings using closing prices. This often produces smoother and more structurally meaningful swing points.

Key Benefits

Filters minor pullbacks and market noise

Clearly displays major highs and lows

Helps visualize overall market structure

Useful during volatile trading periods

Works on all timeframes and currency pairs

Because it focuses on closing prices, it can provide more reliable structural insights when analyzing trend behavior.

How to Use the ZigZag Close Indicator

The ZigZag Close functions primarily as a background analytical tool rather than a direct signal generator. It does not provide fixed BUY or SELL arrows. Instead, it helps traders interpret price structure and confirm setups.

Main Applications

Identifying swing highs and swing lows

Detecting chart patterns (double top, double bottom, head and shoulders)

Elliott Wave analysis

Fibonacci retracement and extension mapping

Harmonic pattern identification

When applying the indicator, traders can define a starting point for historical analysis. The endpoint does not necessarily need to be set for ongoing sessions.

Important Note: Repainting Behavior

The ZigZag Close is a repainting indicator. This means it can redraw its last swing point when a new higher high or lower low forms.

This behavior is normal for ZigZag-based indicators and is why it should not be used as a standalone entry signal tool. Instead, it works best for structural confirmation and post-formation analysis.

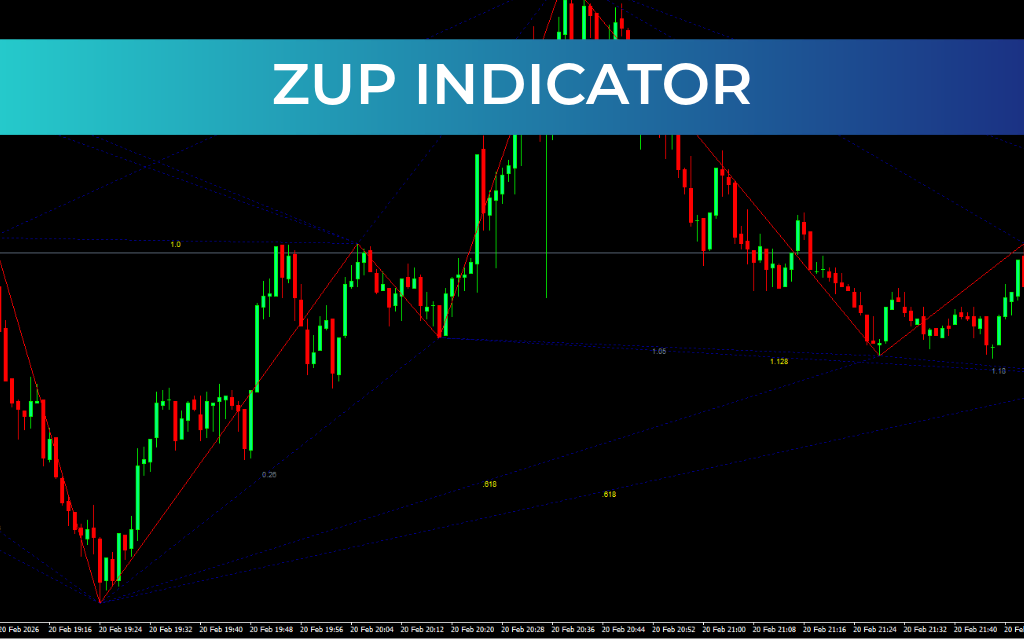

Trading Example Overview

On a USD/CAD H4 chart with default settings (12, 5, 3):

A major high forms at 1.2318

Price declines to 1.2086

A retracement creates a lower high

A double bottom pattern forms

Because the ZigZag Close filters small fluctuations, the double bottom becomes easier to identify. This structural clarity supports a bullish bias and confirms potential buy setups when combined with other tools.

Best Trading Approach

Since the indicator does not provide fixed bullish or bearish signals, it should be used as a confirmation tool within a broader trading strategy.

Effective Combinations

Fibonacci retracement confluence

Support And Resistance levels

Elliott Wave counting

Trendline analysis

Momentum Indicator confirmation

In strong trending markets, retracements may be shallow. Therefore, adjusting the ZigZag settings can help adapt to changing market conditions.

Final Verdict

The ZigZag Close Indicator for MT4 is a powerful structural analysis tool that helps traders visualize meaningful price swings and eliminate market noise. While it does not generate direct trading signals, it excels at confirming patterns and supporting advanced technical analysis.

For best results, combine it with other technical tools and sound risk management practices. Used correctly, it can significantly enhance chart clarity and improve decision-making.