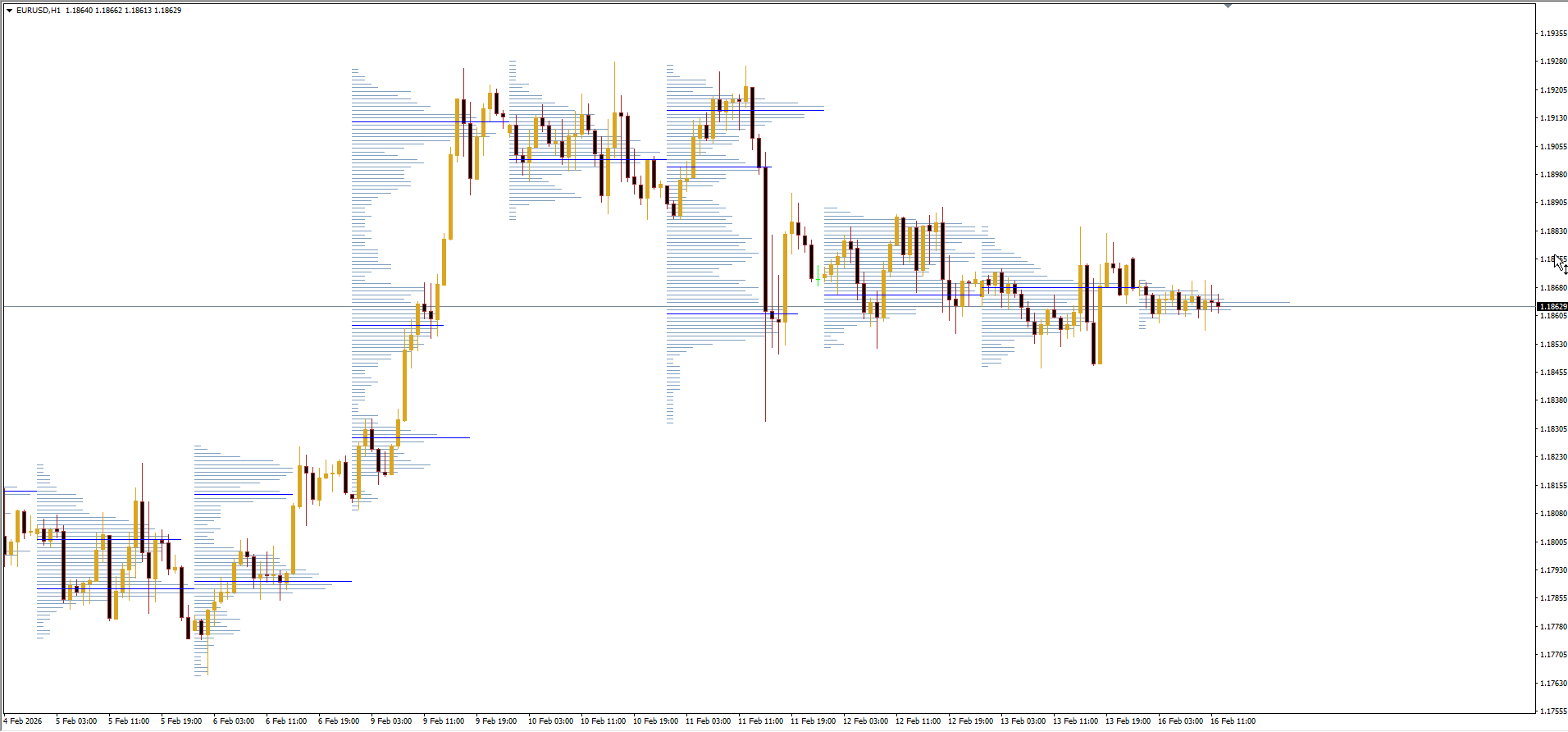

Volume Profile Indicator for MT4 – Identify Key Market Reversals

Trading volume is one of the most important yet often overlooked parameters in technical analysis. High trading activity often signals potential price reversals, making volume a key tool for forex traders. The Volume Profile Indicator for MT4 highlights low volumes, high volumes, and the Volume Point of Control (VPOC), helping traders identify critical Support And Resistance zones.

Why Volume Matters

From experience, adding this indicator to your MT4 terminal is straightforward. Once loaded, the visual representation of volume levels provides a fresh perspective on market areas previously overlooked.

VPOC/POC: Price levels with the highest traded volume, often acting as strong support or resistance

Low Volume Areas: Often represent consolidation or less active zones in the market

High Volume Areas: Potential reversal points or strong market interest zones

For traders exploring market structure through volume, combining this indicator with tools like the TPO Volume Indicator or PZ Market Profile Indicator creates a more complete market view.

Volume Profile Indicator Strategies

On the GBP/USD H1 chart, the Volume Profile indicator can show prices reversing at VPOC zones, continuing the trend through low-volume areas. These zones serve as:

Entry points: Retests at VPOC and high-volume zones

Exit points: Booking profits at the VPOC or high-volume areas

Traders often combine VPOC with TPO (Time Price Opportunities) to construct a full market profile.

Features of the Volume Profile Indicator

Tick Volume: Uses tick volume from the lowest available timeframe to construct the horizontal profile.

Customizable Periods: Select any timeframe from 1 minute to 1 month.

Appearance Options:

Lines: Horizontal lines for volume

Empty Bars: Empty rectangle bars

Filled Bars: Filled rectangle bars

Outline: Outlined line for volume shape

Colors: Solid colors indicating different volume metrics

Additional Metrics

VPOC (Volume Point of Control): Price with the highest traded volume within clusters

Max VPOC: Highlights the single highest VPOC in the selected period

Median Volume: Middle value of volume data to track average activity

VWAP (Volume Weighted Average Price): Weighted average price for more accurate market pricing

Why Traders Use It

Identify potential reversal areas

Mark future support and resistance levels

Optimize entry and exit points

Visualize volume in a user-friendly, customizable format

The indicator is free, easy to download, and works on any timeframe, making it suitable for scalpers, day traders, and swing traders alike. For best results, always combine volume signals with Price Action.

Bottom Line

The Volume Profile Indicator for MT4 is a must-have tool for traders who want to understand market activity beyond just price. By visualizing VPOC, high-volume zones, and low-volume areas, it helps traders anticipate reversals, manage trades efficiently, and confirm price action strategies.