Commodity Channel Index (CCI) Indicator for MT4 – Trend Reversal & Divergence Tool

The Commodity Channel Index (CCI) is one of the most popular oscillators used in forex trading. It helps traders detect trend reversals, divergence, overbought and oversold conditions, and the strength of price momentum relative to its statistical mean over a defined period.

In simple terms, the CCI highlights the strongest and weakest phases of the market, helping traders identify potential turning points.

The CCI indicator for MT4 is suitable for both beginner and experienced traders and is available for free download.

How the CCI Indicator Works

The CCI measures the deviation of price from its average value over a specified time period.

The indicator fluctuates above and below the zero (0) line.

Typical overbought and oversold levels are set at +100 and -100.

The CCI is unbounded, meaning it has no fixed maximum or minimum value.

Key Levels

Above +100 → Overbought condition

Below -100 → Oversold condition

Above 0 → Bullish territory

Below 0 → Bearish territory

Understanding Overbought and Oversold Conditions

Overbought (+100 and above)

When the CCI rises above +100, the market may have experienced an extended upward move. This suggests strong bullish momentum, but also indicates a possible correction if buying pressure weakens.

Overbought does not always mean immediate reversal — it can also signal a strong ongoing trend.

Oversold (-100 and below)

When the CCI falls below -100, the market may be oversold. This indicates heavy selling pressure and the possibility of a bullish reversal if sellers begin to lose control.

Buy and Sell Signals Using CCI

1. Zero Line Strategy

The zero line acts as a trend filter.

Buy Signal

CCI crosses above the 0 line.

Indicates bullish momentum.

Look for long positions.

Sell Signal

CCI crosses below the 0 line.

Indicates bearish momentum.

Look for short positions.

2. Overbought & Oversold Reversal Strategy

Buy Setup

CCI moves below -100 (oversold).

Watch for bullish reversal Candlestick Patterns.

Enter long when price shows confirmation.

Sell Setup

CCI moves above +100 (overbought).

Wait for bearish reversal confirmation.

Enter short when price structure supports the move.

3. Divergence Strategy (Advanced Method)

Divergence occurs when price makes a new high or low, but the CCI does not confirm it.

Bullish Divergence: Price makes a lower low, CCI makes a higher low → Potential upward reversal.

Bearish Divergence: Price makes a higher high, CCI makes a lower high → Potential downward reversal.

Divergence is one of the strongest reversal signals when combined with support/resistance levels.

Practical Chart Example Explanation

When price enters the oversold region after a strong downtrend, it often signals weakening bearish momentum and a potential bullish rebound.

If price enters the overbought region but fails to reverse, it may indicate a strong ongoing uptrend.

Multiple tests of overbought/oversold zones combined with chart patterns (such as double tops or bottoms) significantly strengthen reversal signals.

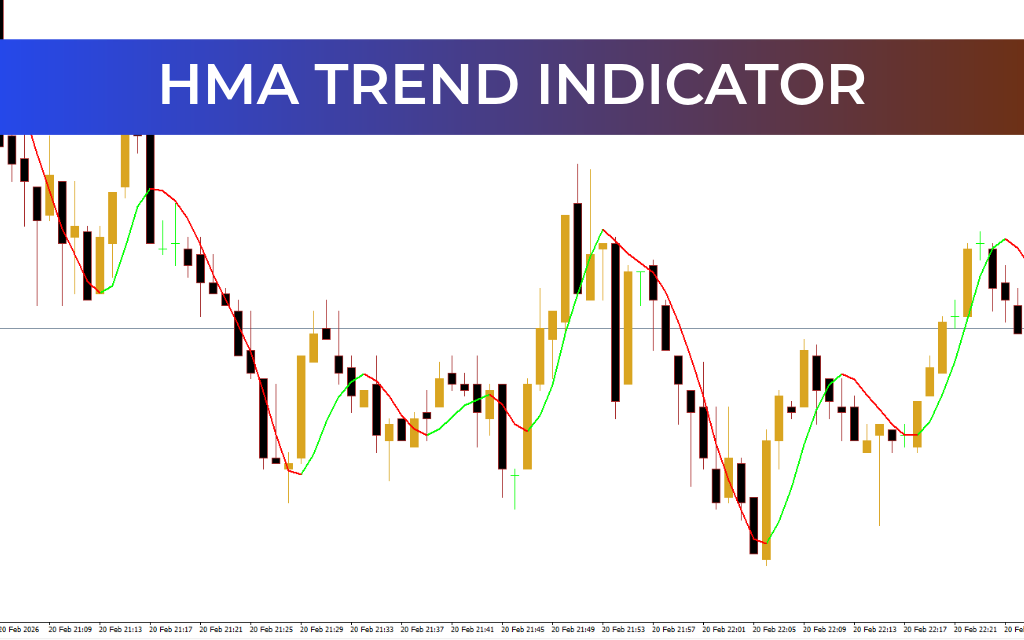

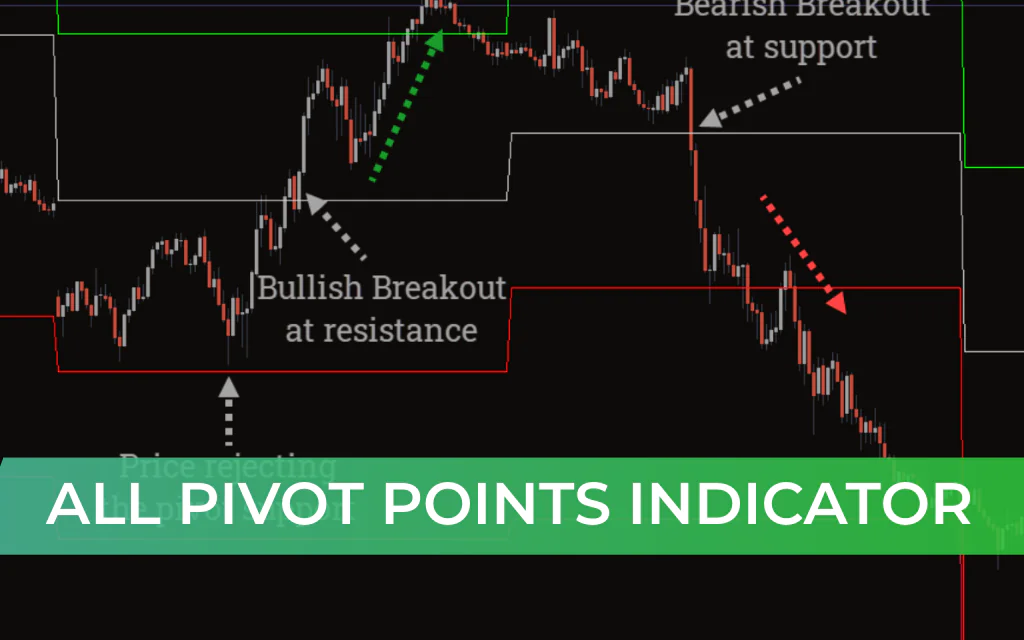

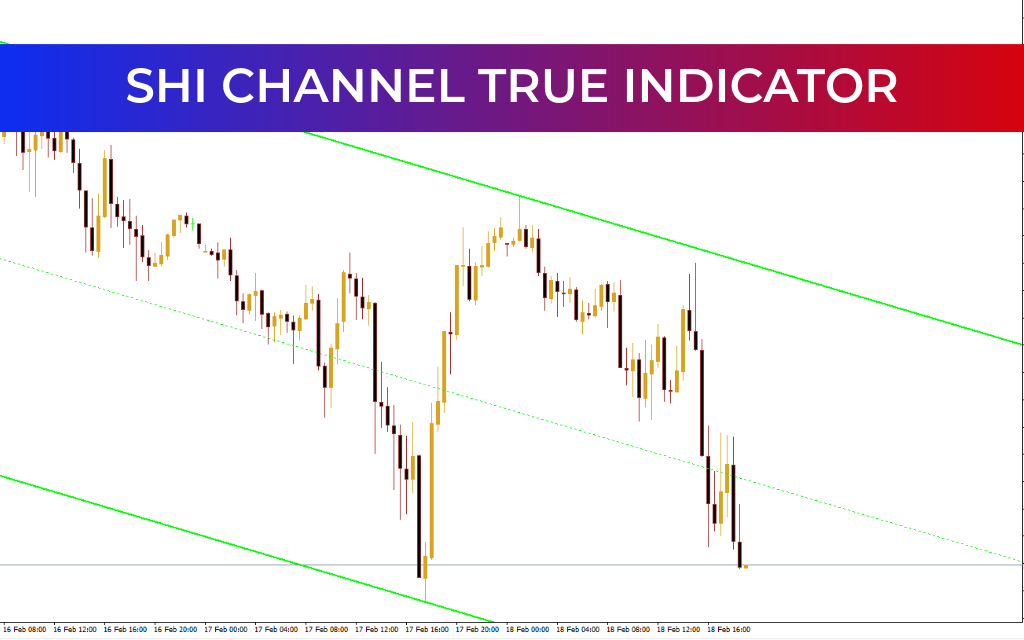

Always combine CCI signals with:

Support And Resistance zones

Chart patterns

Candlestick confirmations

Trendline analysis

Benefits of the CCI Indicator

Identifies strong and weak market phases

Detects divergence effectively

Helps filter Trend Strength

Suitable for reversal and trend-following strategies

Works on all timeframes

Important Considerations

CCI is unbounded — extreme readings can continue during strong trends.

Do not rely solely on +100 and -100 levels.

Use confluence with Price Action for better accuracy.

Conclusion

The Commodity Channel Index (CCI) Indicator for MT4 is a powerful momentum oscillator that helps traders determine whether to ride a strong trend or prepare for a reversal.

It identifies overbought and oversold conditions, measures trend strength, and highlights divergence opportunities. However, like most technical indicators, it performs best when combined with other analysis tools for confirmation.

Used properly, CCI can significantly improve entry timing and overall trading precision.