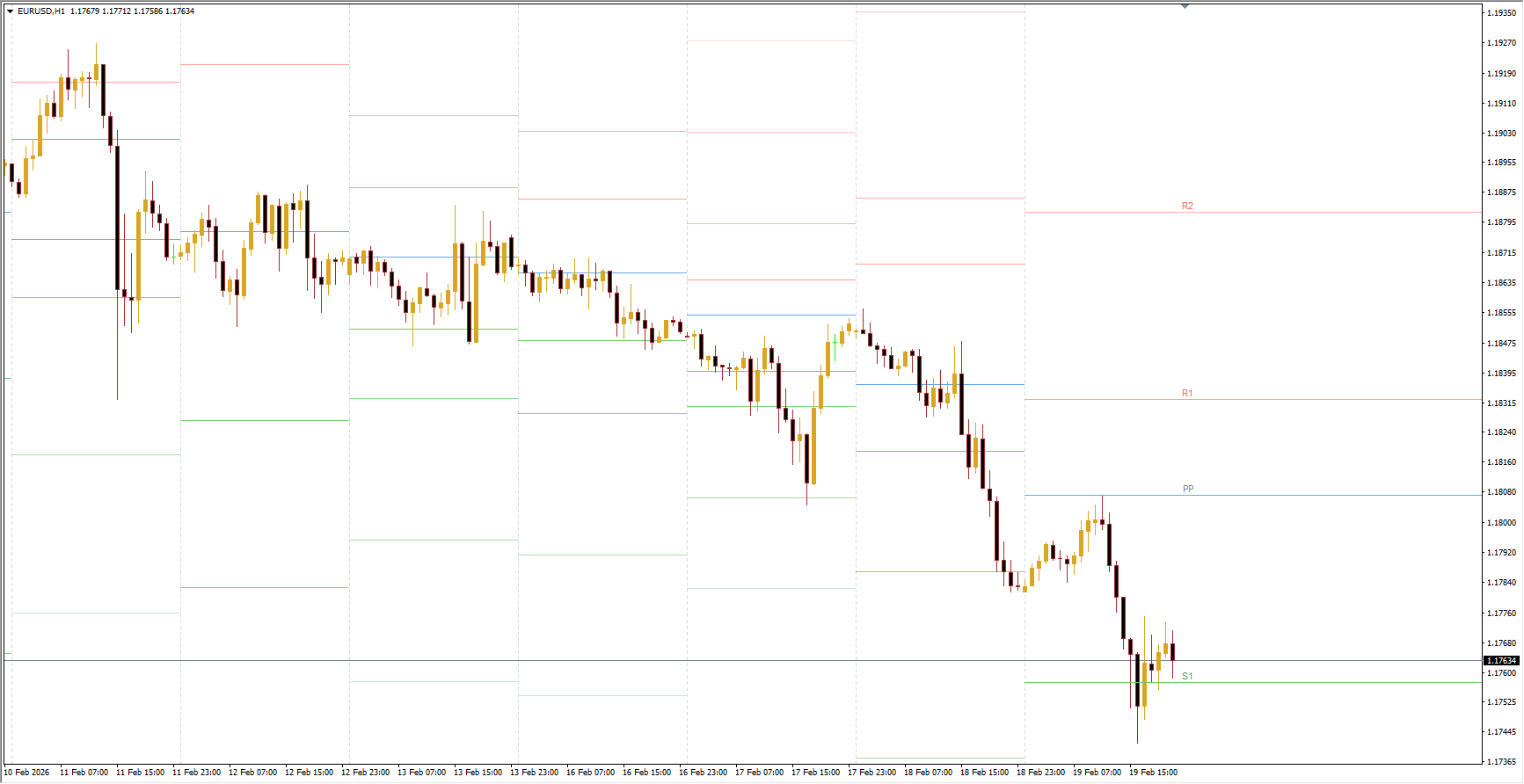

The Pivot Points All-In-One Indicator combines the most popular methods of calculating support, resistance, and reversal levels into a single powerful MetaTrader 4 tool. Instead of switching between multiple indicators, traders can access every major pivot calculation method in one place.

Support And Resistance levels are among the most widely used tools in forex trading because they help identify Trend Reversal zones, entry opportunities, and profit targets. Since MT4 does not include a built-in automatic pivot level indicator, this tool provides a convenient and reliable solution.

What Makes This Indicator Unique

The Pivot Points All-In-One automatically plots pivot levels on your MT4 chart. When price interacts with these levels, it often signals potential trend reversals or continuation zones.

What makes it special is that it combines all major pivot calculation methods:

Classical

Woodie

Fibonacci

Camarilla

Central Pivot Range (CPR)

Each method uses different formulas, so pivot levels may vary slightly depending on the selected approach. However, all are displayed clearly on the chart for easy interpretation.

Pivot Level Calculation Methods

Classical

One of the most widely used methods.

Based on the previous session’s high, low, and closing price.

Popular among traders, so price interaction is often strong.

Woodie

Places more emphasis on the previous closing price.

Helps identify highly probable reversal zones.

Useful for traders holding positions across different timeframes.

Fibonacci

Based on Fibonacci retracement theory.

Ideal for identifying Trend Continuation after corrections.

Suitable for mid-term and trend-following traders.

Camarilla

Places support and resistance levels close to pivot points.

Excellent for scalpers and intraday traders.

Helps identify quick reversal zones.

Central Pivot Range (CPR)

Uses three levels: central pivot, upper range, and lower range.

Helps identify overall market direction.

Price above levels → bullish trend

Price below levels → bearish trend

Effective for trend and market phase analysis.

What Traders Can Achieve with This Indicator

Identify trend reversal and continuation points

Determine stop-loss and take-profit levels

Find trend-aligned entry opportunities

Understand market structure and momentum

Adapt pivot calculation method to trading style

Practical Trading Applications

Trend Resumption Using Fibonacci Levels

Fibonacci pivots help identify corrections within the main trend. When price slows near a support level and resumes upward momentum, traders may enter in the direction of the trend while placing stop loss beyond support.

Stop Loss & Take Profit with Classical Levels

Classical pivot levels are widely respected. Traders often place stop losses beyond strong support levels (like S1) and target resistance levels (R1 or R2) for profit. Scaling out positions helps manage risk when market momentum weakens.

Conclusion

The Pivot Points All-In-One Indicator for MT4 is a complete solution for traders who rely on support and resistance analysis. By combining multiple pivot calculation methods into one indicator, it provides flexibility, accuracy, and efficiency for different trading strategies. Whether you are a scalper, intraday trader, or trend follower, this tool can enhance your decision-making and trading performance.