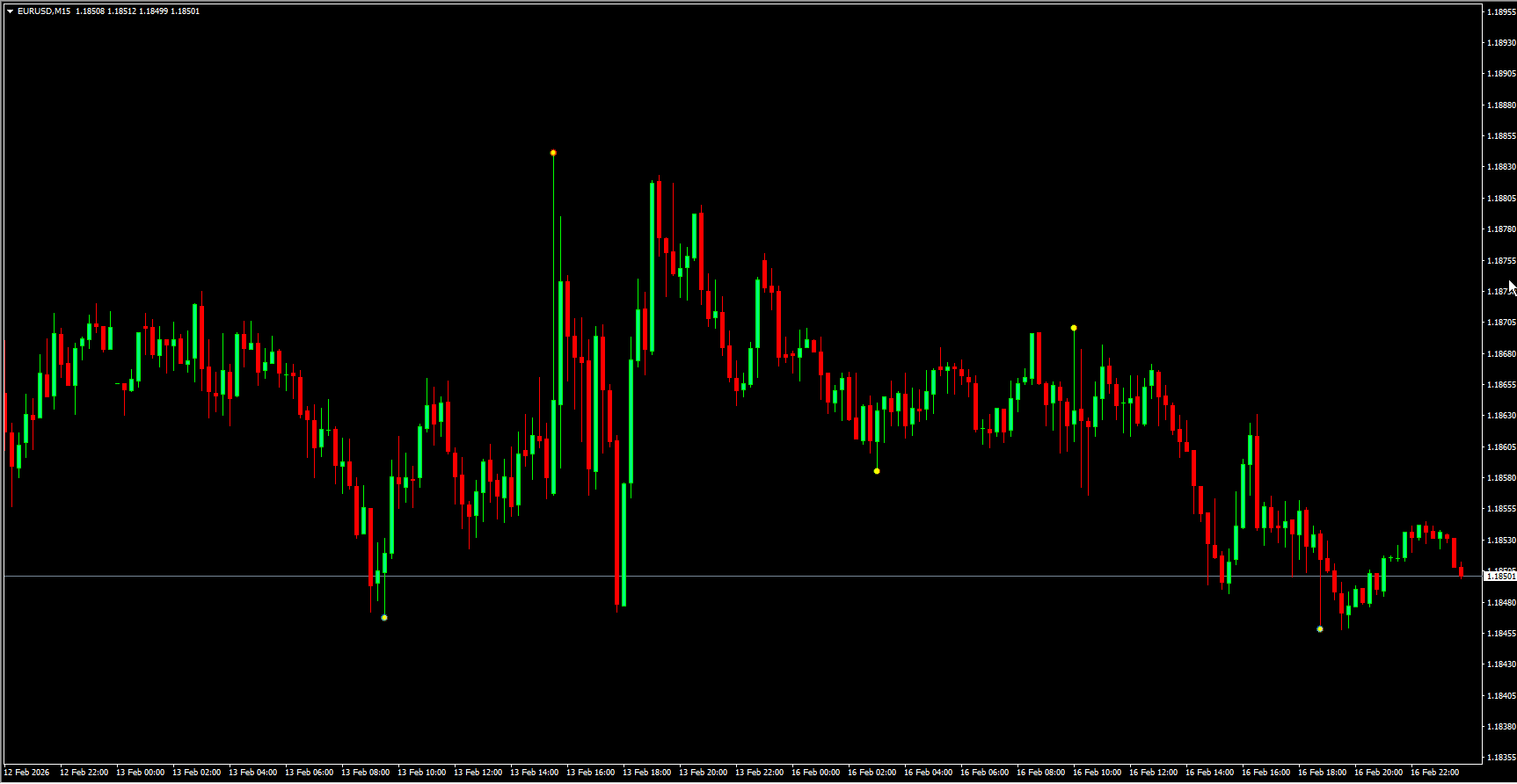

The indicator appears on the chart as yellow dots encircled by colored rings. A yellow dot with a red ring signals a potential market top, indicating a reversal to a downtrend. Conversely, a yellow dot with a blue ring signals a potential market bottom and a reversal to an uptrend.

Although the indicator is highly effective, it may repaint signals, meaning that earlier dots may change positions as new price data becomes available. This characteristic requires traders to adopt strategies to minimize the impact of repainting.

How to Use the Forex Reversal Indicator

Combining With Other Trend Indicators

One effective approach is to use the Forex Reversal Indicator alongside a trend-following tool such as the FXSSI Trix Crossover. When both indicators align, traders can take positions in the direction of the prevailing trend:

If the reversal indicator signals an uptrend, use the Trix Crossover to identify buy opportunities.

If the reversal indicator signals a downtrend, use the Trix Crossover to identify sell opportunities.

This method helps filter out false signals and ensures trades align with the broader trend.

Trading the Indicator Signals Directly

A more advanced method involves trading directly from the reversal signals. Because the indicator can repaint, it is recommended to use signals only in conjunction with other technical analysis tools such as Support And Resistance levels, price action patterns, or additional indicators. Confluence from multiple sources increases the reliability of each signal.

Who Should Use the Forex Reversal Indicator

This indicator is best suited for intermediate and expert traders who are experienced in combining multiple tools and strategies to generate trade signals. It is particularly effective for swing and position traders operating on higher timeframes, where the signals tend to be more stable and reliable. Scalpers and traders using very short timeframes should generally avoid relying on this indicator due to the repainting effect.