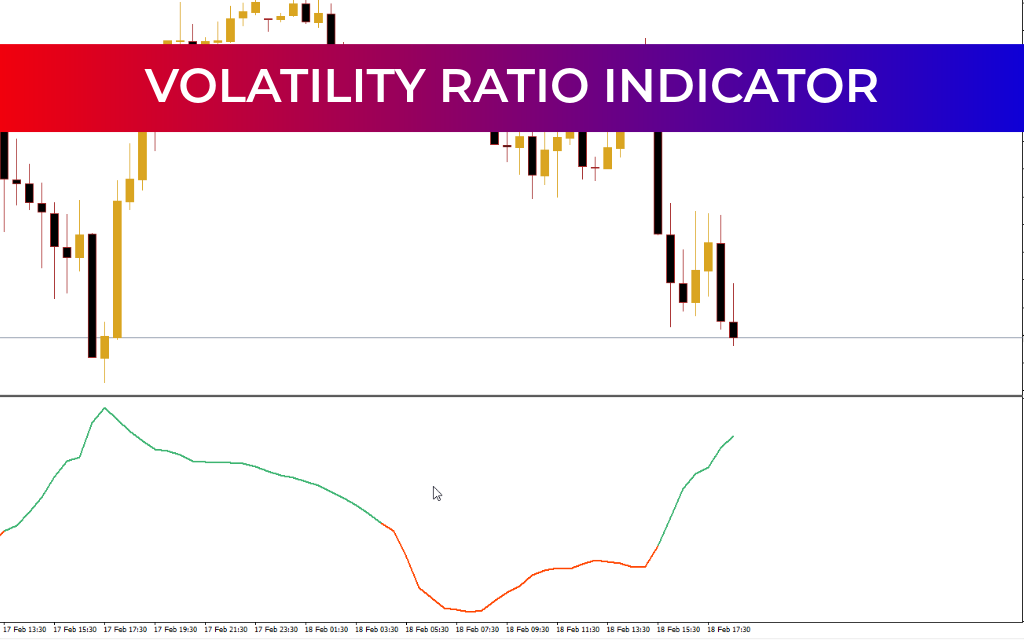

The Volatility Ratio MT4 Indicator is an essential tool for forex traders who rely on technical analysis under varying market conditions. Many technical indicators produce false signals when volatility is low, making volatility-based tools critical for confirming market activity. The Volatility Ratio Indicator detects the presence or absence of volatility and visually signals it through a color change, helping traders make more informed decisions during breakouts, Trend Continuation, or profit booking.

How It Works

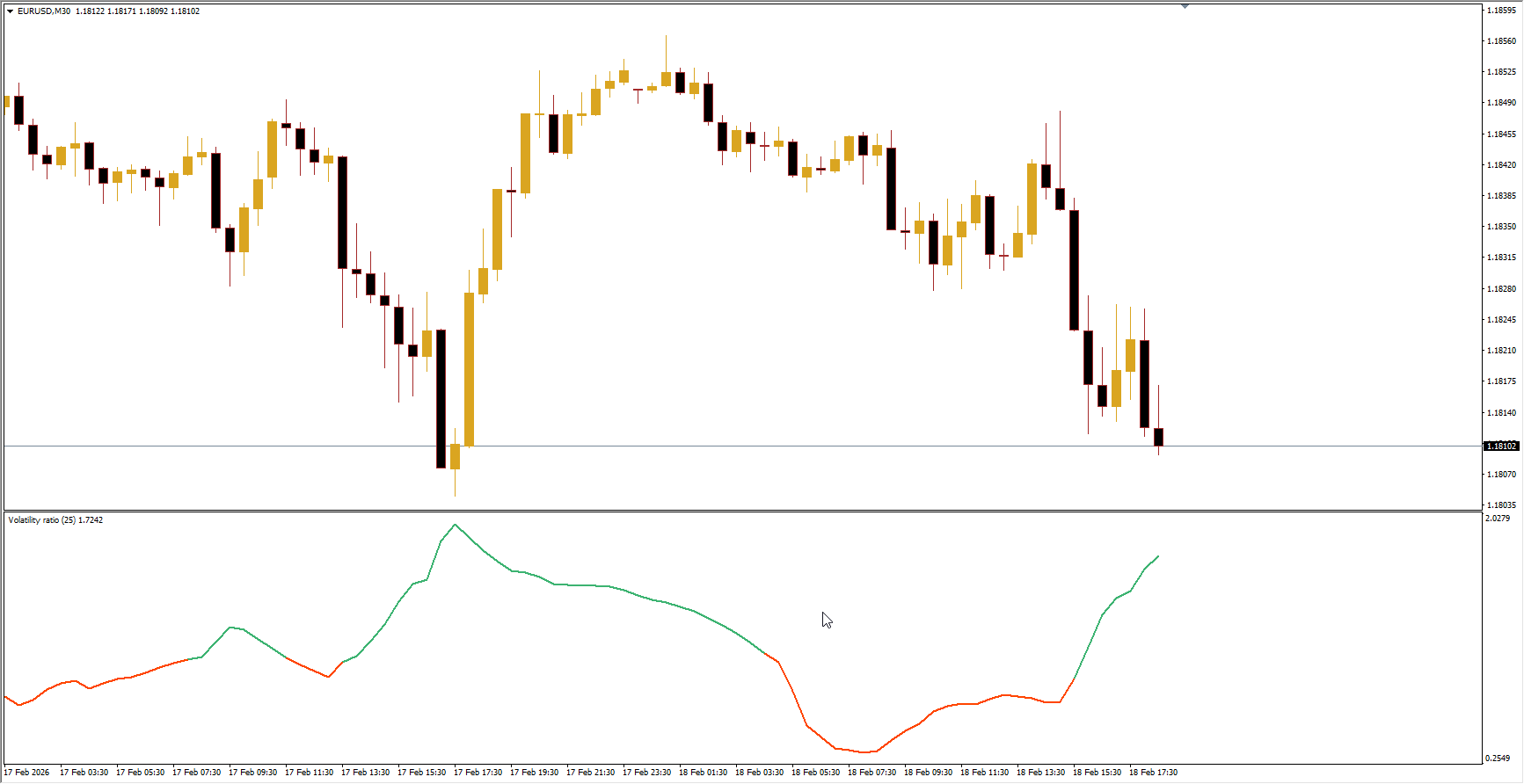

The Volatility Ratio Indicator measures forex market volatility by comparing current price deviations relative to historical averages. It is displayed in a separate MT4 window:

Volatility Present (Value Above 1): Line turns Medium Sea Green, indicating sufficient market activity to rely on technical signals.

Volatility Absent (Value Below 1): Line turns Orange-Red, signaling low market activity and a higher risk of false signals.

Visual Clarity: Traders can add a level line at value 1 to quickly identify the threshold between volatility and calm market conditions.

By monitoring volatility, traders can determine when technical indicators are likely to produce reliable signals and when caution is warranted.

Trading Applications

Breakout Trading: Wait for volatility confirmation before acting on a breakout. A breakout during low volatility may result in false signals.

Trend Following: Combine with trend indicators to trade in the trend direction when volatility increases.

Profit Booking: Declining volatility can signal a potential exit or partial profit-taking opportunity.

Multi-Indicator Strategies: Works best when used alongside leading indicators to confirm market conditions before executing trades.

Key Features

Volatility Detection: Identifies the presence or absence of market volatility.

Color-Coded Display: Medium Sea Green for active markets; Orange-Red for low volatility.

Customizable Levels: Add visual reference lines for easy interpretation.

MT4 Compatible: Works in any timeframe and displays in a separate window.

Supports Technical Analysis: Enhances decision-making when used with other indicators for trend or breakout strategies.

Understanding Volatility

Volatility measures the degree of price fluctuations of a currency pair. It can be classified as:

Historical Volatility: Examines past price fluctuations to identify trends and risk levels.

Implied Volatility: Estimates expected future price movements, often influenced by economic events or news releases.

High-impact news events often trigger volatility spikes, making volatility analysis essential for informed forex trading.

Conclusion

The Volatility Ratio MT4 Indicator does not provide buy or sell signals on its own. Instead, it indicates whether the market is experiencing sufficient volatility for reliable trading. Forex traders should combine this indicator with trend or breakout indicators to make informed trading decisions. By integrating volatility analysis into technical strategies, traders can reduce false signals, time entries more effectively, and optimize exits for maximum profit.