As a professional trader, I’m constantly testing automated strategies to streamline workflow and diversify trading. One expert advisor that stood out recently is the Apex Scalper EA for MT4. After several weeks of forward testing, it delivers a disciplined and efficient approach to Scalping—particularly in trending markets.

Unlike many over-optimized EAs that promise high profits but lead to blown accounts, Apex Scalper EA maintains balanced trading logic. It executes trades with precision, uses clear stop-loss rules, and avoids overtrading. Drawdowns are tightly managed, and entries are surprisingly accurate given its scalping nature.

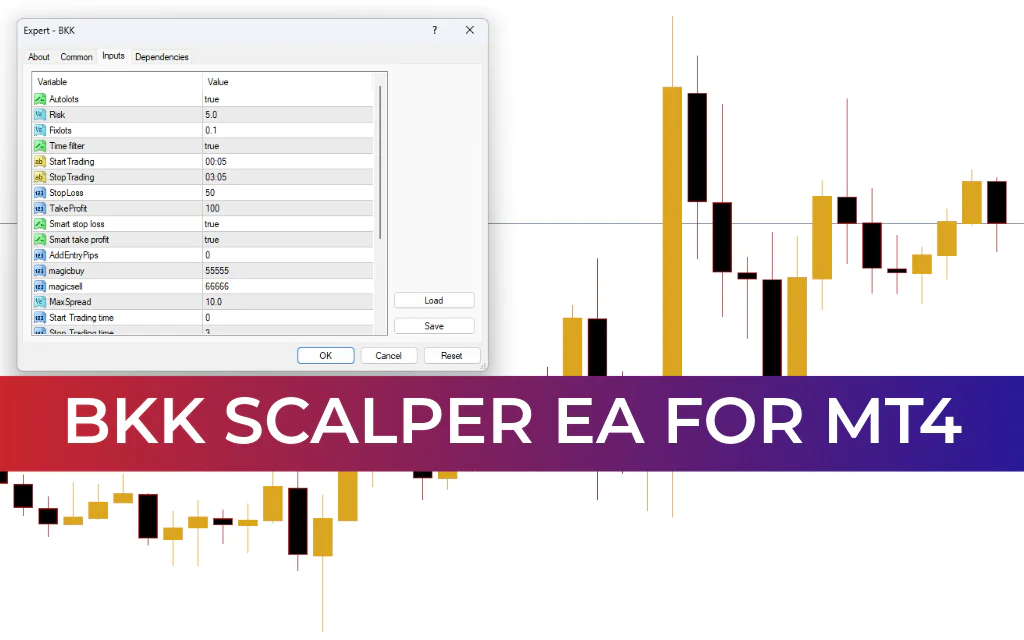

Recommended Settings

Currency Pairs: GBPUSD, EURUSD, AUDCAD (best results on majors)

Timeframes: H1 (1-hour charts)

Minimum Deposit: $500 (recommended $1,000+ for safety)

Leverage: 1:100 or higher

Account Type: ECN or Raw Spread for tight execution and minimal slippage

Key Features of Apex Scalper EA

Built-in money management with customizable lot sizing

Adjustable entry logic and time filters

Supports multiple magic numbers for portfolio setups

Informative on-screen panel showing balance, profit, spread, and status

Works without Martingale or Grid to maintain stable risk

Broker time filter to trade only during high-activity hours

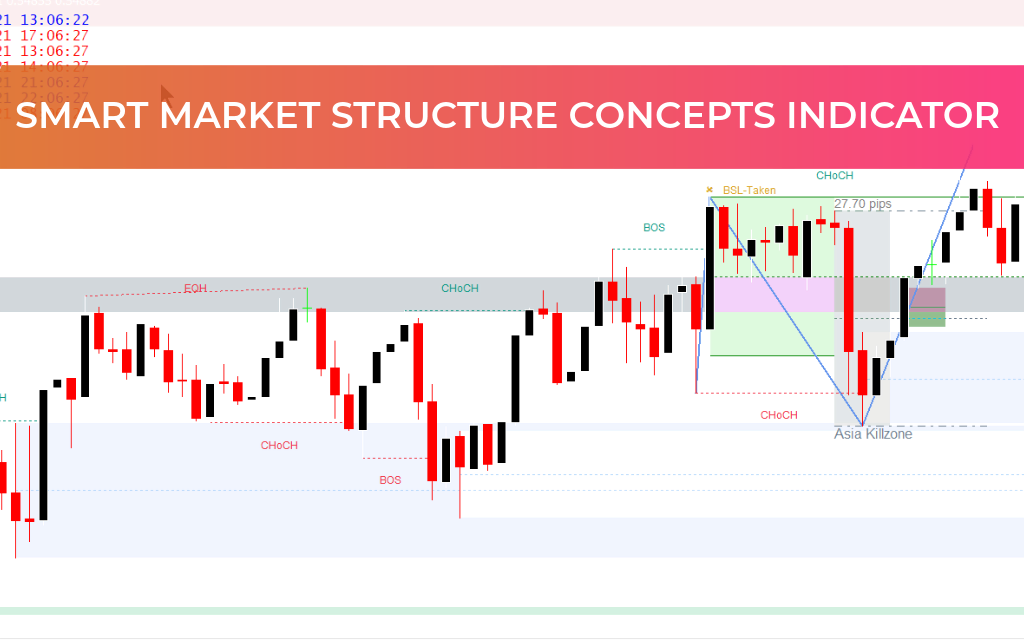

Uses Market Structure and momentum for entries (no repainting indicators)

How Apex Scalper EA Works

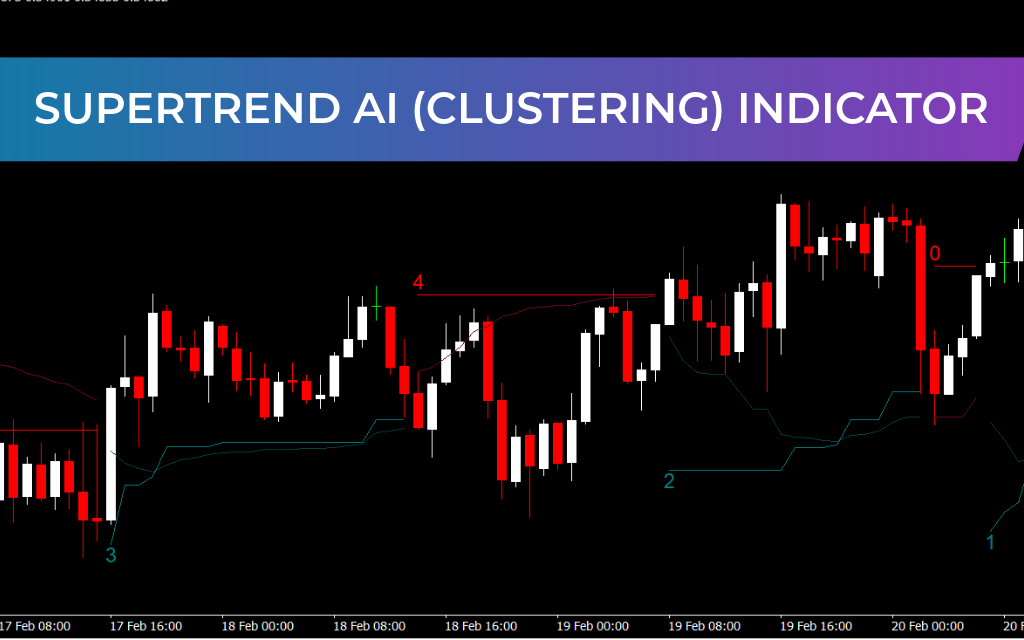

Apex Scalper EA targets high-volatility breakouts and retracement continuations. It avoids chasing the market and waits for ideal entry zones, typically after consolidation phases. Using Price Action triggers and momentum indicators, it times entries and exits precisely.

Trades are typically held for a limited number of candles

Performs best during moderate-to-strong trending sessions

Avoids trading during major news events if broker time filter is applied

Trading Signals

The EA generates signals based on candlestick structure and internal momentum filters:

Buy signals: Above minor resistance zones after consolidation

Sell signals: Below minor support zones in continuation patterns

Exit strategy: Predefined stop-loss and take-profit, or trailing logic in volatile markets

Pending orders are often placed instead of market orders, reducing slippage and improving trade control.

Pros & Cons

Pros:

Low and controlled drawdowns (max 3.5%–5% during sideways periods)

Accurate entries in trending conditions

Smooth performance on H1 timeframe

Minimal overtrading, keeping accounts stable

Cons:

Less effective in choppy, sideways markets

Requires ECN broker for optimal low-spread execution

Slower profits on low-volatility pairs

Conclusion

From my professional testing, the Apex Scalper EA for MT4 is one of the more reliable scalping bots available. Its disciplined logic, controlled risk, and precise entries make it a strong choice for traders looking for consistent, automated scalping—especially in trending markets.