SuperTrend AI (Clustering) Indicator for MetaTrader 4 – AI-Adaptive Trend Detection & Trade Management

The SuperTrend AI (Clustering) Indicator, developed by LuxAlgo for MetaTrader 4, represents a major evolution in traditional trend-following systems.

Unlike standard SuperTrend tools that rely on fixed parameters, this advanced version integrates AI-powered clustering logic to dynamically adjust trailing stops and trend filters. By analyzing historical price behavior and automatically selecting optimized parameter groupings, the indicator adapts in real time to changing market conditions.

This makes it particularly powerful in:

Fast-moving markets

High-volatility environments

Unstable or transitioning trend phases

How SuperTrend AI (Clustering) Works

The indicator combines:

Adaptive Moving Averages (AMA)

AI-based clustering zones

Dynamic trailing stop logic

Instead of applying a static multiplier, the system evaluates multiple trailing stop configurations and clusters them based on historical performance. It then applies the most statistically favorable setup to current Price Action.

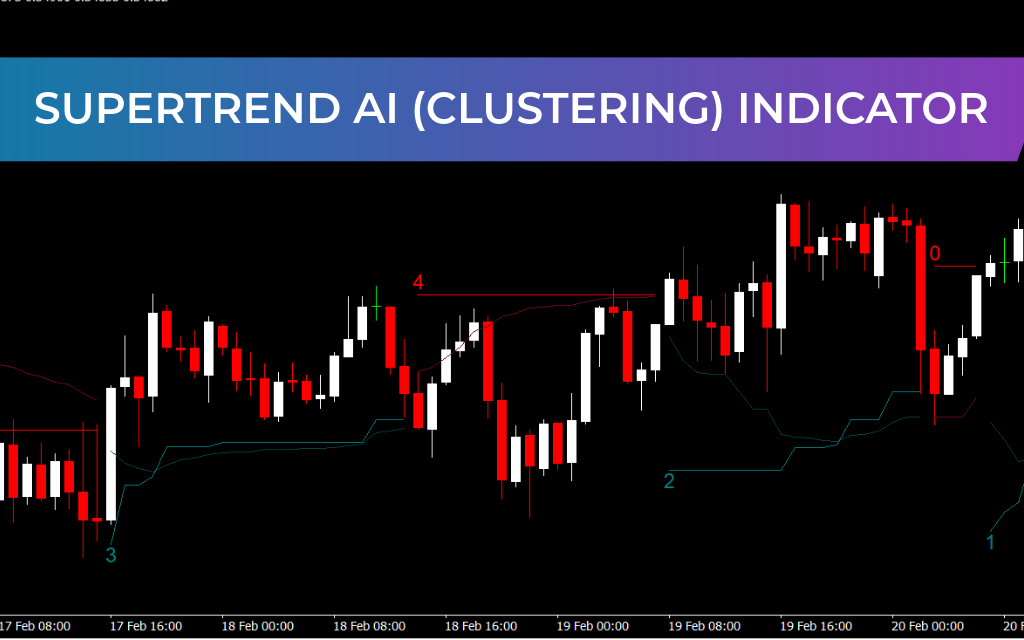

Trading Signals & Visual Structure

🟢 Bullish Trend Signal

A teal trailing stop line appears below price

A clustering label (e.g., “0”) may display

Indicates strong bullish continuation potential

The trailing line acts as both:

Trend confirmation

Dynamic stop-loss guidance

🔴 Bearish Trend Signal

A red trailing stop line appears above price

Clustering labels such as “1,” “2,” or “3” reflect varying strength levels

Suggests bearish continuation or downside pressure

Each clustering level represents a different AI-optimized trailing configuration, giving traders visual insight into trend quality and momentum strength.

Understanding Clustering Levels

The numeric clustering labels indicate how the AI groups price behavior:

Lower values → Stronger trend consistency

Higher values → Increased variability or weaker structure

This allows traders to:

Gauge confidence in a move

Decide whether to hold or tighten stops

Exit early during weakening momentum

Why Use SuperTrend AI (Clustering)?

✔ Dynamically adapts to market conditions

✔ AI-optimized trailing stops

✔ Improves exit timing

✔ Reduces false signals in volatile markets

✔ Works well on high-volatility pairs like GBPJPY

In volatile instruments where traditional trend tools may lag or give premature exits, this adaptive system maintains structural integrity while responding intelligently to price shifts.

Best Trading Applications

Trend-following systems

Breakout strategies

Momentum trading

Volatility-based setups

AI-assisted discretionary trading

It works effectively on intraday and higher timeframes, offering structured trade management across multiple market conditions.

Conclusion

The SuperTrend AI (Clustering) Indicator for MetaTrader 4 by LuxAlgo is a powerful upgrade to conventional trend tools.

By integrating AI-driven clustering and adaptive moving averages, it intelligently refines trailing stops and trend detection — providing traders with:

More precise entries

Smarter exits

Improved risk control

Higher adaptability in volatile markets

Whether you trade breakouts, trends, or reversals, this AI-enhanced tool adds clarity, structure, and advanced trade management to your strategy.