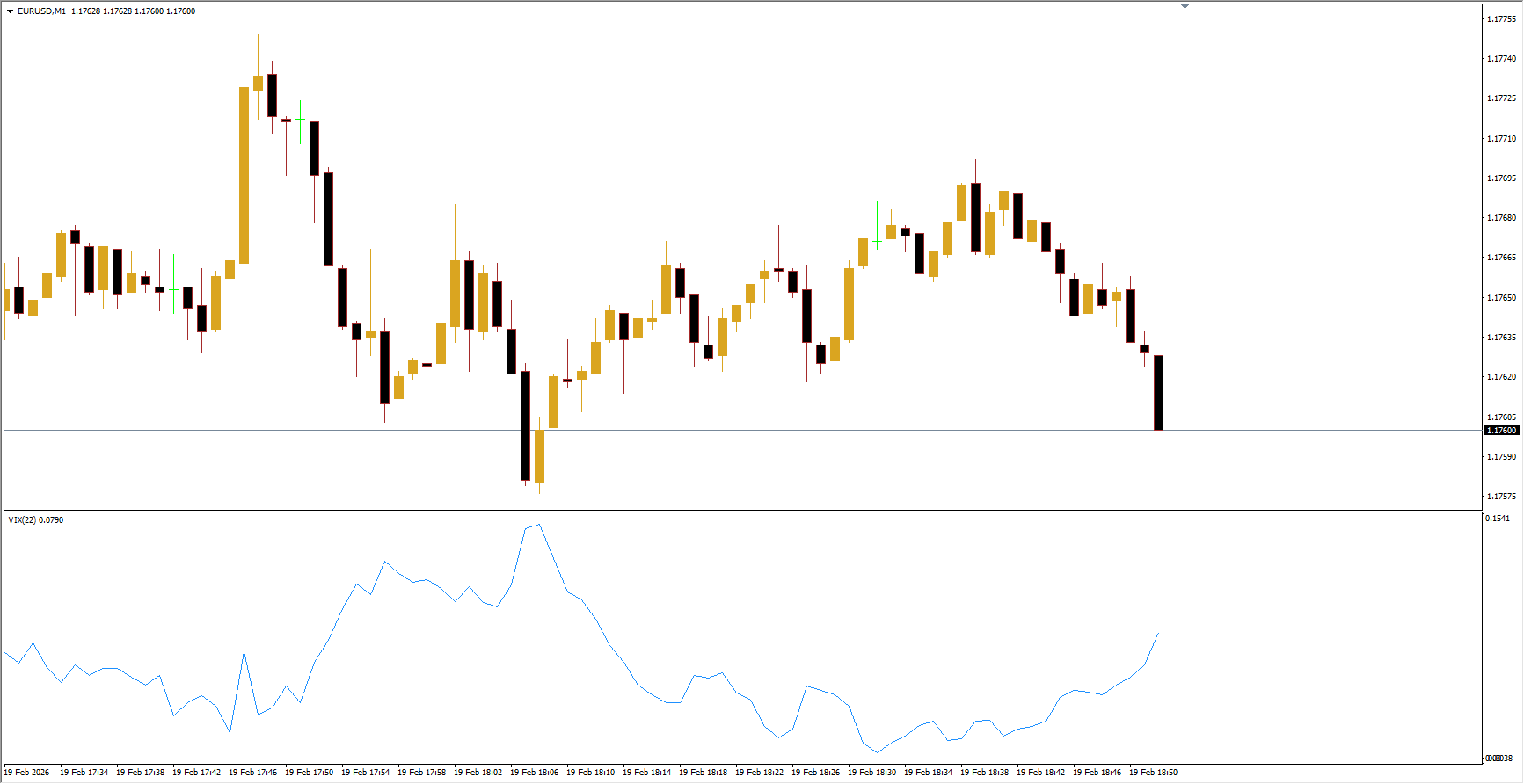

The Synthetic VIX Indicator is a market volatility meter designed to monitor price-action changes and calculate the market’s volatility index. Originally developed for the S&P 500, this indicator can now be applied to forex currency pairs, stocks, and other trading assets, making it a versatile tool for traders of all levels.

How Synthetic VIX Works

Uses historical price data and a 22-period moving average to estimate market volatility.

Calculates the index with the formula:

- Synthetic VIX value=Highest(Close, 22) – LowHighest(Close, 22)\text{Synthetic VIX value} = \frac{\text{Highest(Close, 22) – Low}}{\text{Highest(Close, 22)}}Synthetic VIX value=Highest(Close, 22)Highest(Close, 22) – Low

Optionally, the value can be multiplied by 100 to scale the readings.

The indicator reflects market sentiment, showing when buyers or sellers dominate.

How to Use Synthetic VIX

Not a buy/sell signal indicator: It shows current market volatility rather than entry or exit points.

Price behavior relationship:

Price tends to rise as the VIX falls from high levels (~1.0).

Price tends to decline as the VIX rises from low levels (~0.0).

Ideal for sideways markets or range-bound conditions, helping traders identify potential breakouts or swing setups.

Advantages of Synthetic VIX

Displays real-time volatility of the market.

Shows buyer and seller sentiment under all market conditions.

Helps identify price breakouts and swing patterns.

Simple to use, suitable for beginners.

Can be combined with any trading strategy.

Conclusion

The Synthetic VIX Indicator is a valuable tool for traders who base decisions on market volatility. It is effective across forex, stocks, and other trading assets. Its simplicity and visual clarity make it perfect for both beginners and experienced price-action traders seeking to understand market sentiment and volatility trends.