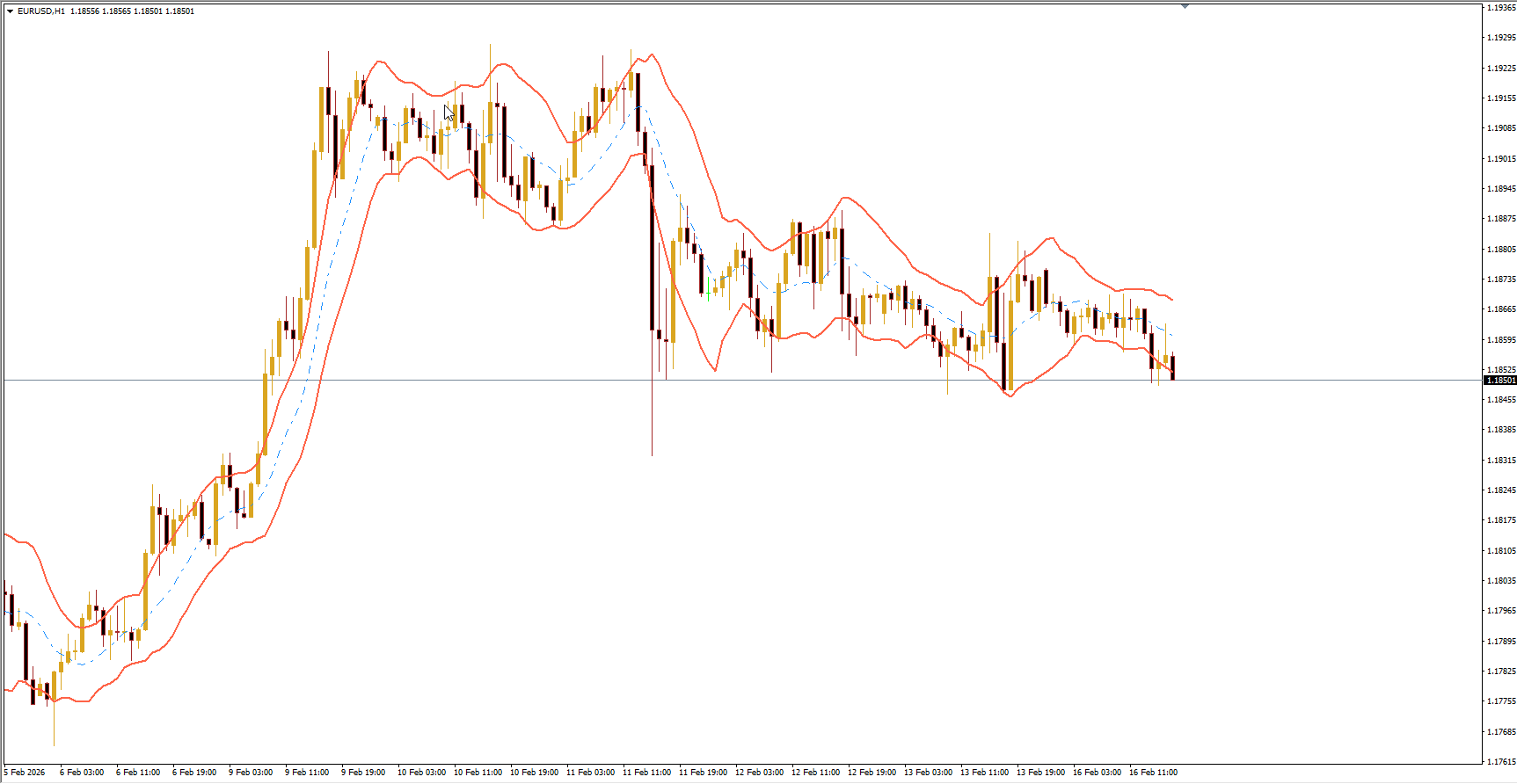

Keltner Channel Indicator for MT4 – Identify Trends with Confidence

Have you ever heard the phrase “always trade with the trend” but struggled to determine whether the market is actually trending up or down? Many traders face this challenge. The Keltner Channel (KC) Indicator for MT4 is designed to solve exactly that problem.

It helps traders identify trends, potential reversals, and breakout opportunities using a simple channel structure around price.

What Is the Keltner Channel Indicator?

The Keltner Channel consists of three bands plotted around price:

Upper band

Middle band

Lower band

Price typically moves within these bands, oscillating between the upper and lower boundaries depending on market momentum and volatility.

Why Traders Use the Keltner Channel

The Keltner Channel offers several important advantages:

1. Trend Identification

An upward-sloping channel indicates an uptrend

A downward-sloping channel indicates a downtrend

2. Reversal Detection

It can signal when a trend is losing strength and may reverse.

3. Breakout Confirmation

Price closing outside the channel often signals strong momentum and potential continuation.

4. Reduced False Signals

Compared to similar tools like Bollinger Bands, the Keltner Channel is less sensitive to sudden price spikes at default settings. This makes it more resistant to false breakouts.

Traders can adjust the settings to make the channel more responsive or smoother, depending on their strategy.

How the Keltner Channel Is Calculated

The indicator is based on two key components:

EMA (Exponential Moving Average) – tracks recent price changes

ATR (Average True Range) – measures market volatility

Formula

Upper Band: EMA + (Multiplier × ATR)

Lower Band: EMA − (Multiplier × ATR)

Middle Band: EMA

Default Settings

EMA period: 20

ATR period: 10

Multiplier: 2

A higher EMA period creates a smoother, slower channel. A lower EMA makes it more responsive.

A larger multiplier widens the channel, while a smaller multiplier narrows it.

How to Trade Using the Keltner Channel

1. Dynamic Support and Resistance

The channel acts as a moving Support And Resistance system.

Uptrend conditions:

Price stays in the upper half of the channel

Often bounces between middle and upper band

Downtrend conditions:

Price stays in the lower half

Often moves between middle and lower band

Trade in the direction of the channel slope.

2. Breakout Trading

When price opens inside the channel but closes outside it, this signals strong momentum.

Breakouts often lead to:

Short-term continuation moves

Start of major trends

Traders typically enter in the direction of the breakout.

3. Trend Reversal Signals

Momentum loss can hint at reversals.

Possible uptrend exhaustion:

Price repeatedly touches the upper band

Eventually drops toward the lower band

Possible downtrend exhaustion:

Price repeatedly hits the lower band

Moves strongly toward the upper band

These shifts may signal trend change.

Who Should Use the Keltner Channel?

This indicator is ideal for:

Beginners learning to identify trends

Trend-following traders

Reversal traders

Breakout traders

Because it provides clear visual structure, it’s especially helpful for traders who struggle to interpret market direction.

Bottom Line

The Keltner Channel Indicator is a powerful and versatile trend tool. It helps traders:

Identify trend direction

Spot breakouts

Detect potential reversals

Trade dynamic support and resistance

Its balanced sensitivity and clear visual signals make it suitable for both beginners and experienced traders.

If you want a simple way to understand market structure and trade with the trend, the Keltner Channel is an excellent addition to your MT4 toolkit.