RSI Divergence Indicator for MT4 – Spot Powerful Reversal Signals Early

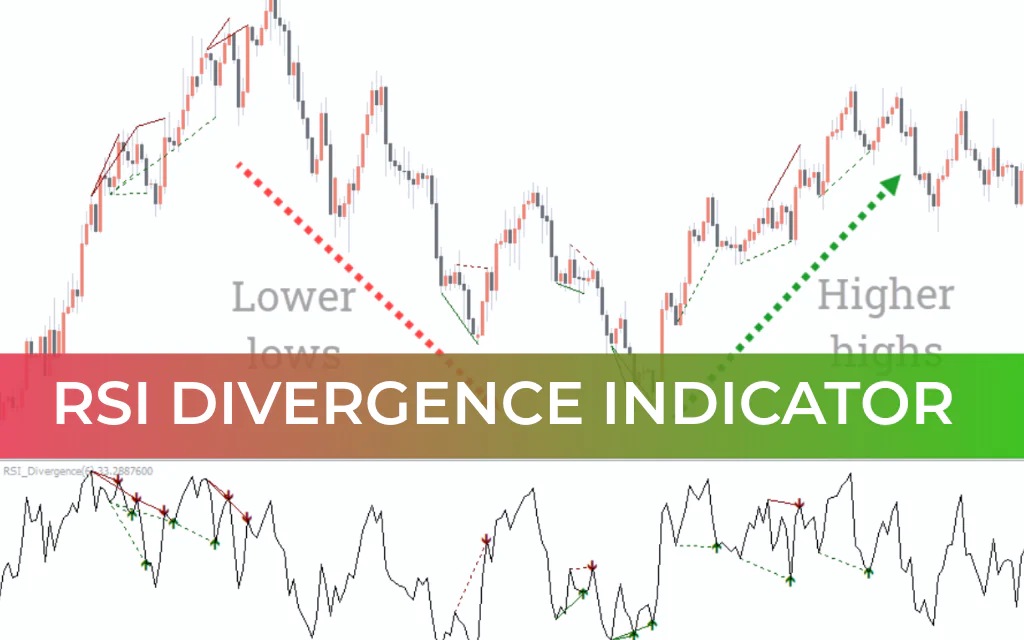

When Price Action and the RSI indicator stop reflecting the same momentum, a divergence occurs — and that’s where high-probability trading opportunities begin.

The RSI Divergence Indicator for MT4 helps traders detect bullish and bearish divergences automatically, making it easier to anticipate potential reversals and trend continuations.

What is the RSI Divergence Indicator?

The RSI (Relative Strength Index) is a popular Momentum Indicator that measures price strength on a scale from 0 to 100:

Below 30 → Market is considered oversold

Above 70 → Market is considered overbought

However, one major limitation of the standard RSI is that it does not always reach extreme levels, and it can generate false signals in strong trends.

The RSI Divergence Indicator solves this problem by identifying momentum divergence between price and RSI, helping traders anticipate possible reversals before they happen.

What is RSI Divergence?

Divergence occurs when price and RSI move in opposite directions:

Bullish Divergence

Price makes lower lows

RSI makes higher lows

Indicates weakening selling pressure

Potential BUY opportunity

Bearish Divergence

Price makes higher highs

RSI makes lower highs

Indicates weakening buying pressure

Potential SELL opportunity

A divergence suggests that the current trend is losing strength and may reverse or pull back.

RSI Divergence Indicator BUY & SELL Signals

Buy Setup (Bullish Divergence)

Price forms lower lows

RSI forms higher lows

RSI is near or below the oversold level (30)

Enter BUY after confirmation candle or when RSI exits oversold

Place stop-loss near the recent swing low

Exit when RSI starts turning downward or bearish divergence forms

Sell Setup (Bearish Divergence)

Price forms higher highs

RSI forms lower highs

RSI is near or above the overbought level (70)

Enter SELL after confirmation candle or when RSI exits overbought

Place stop-loss near the recent swing high

Exit when RSI starts turning upward or bullish divergence forms

Why Use RSI Divergence?

Detects early trend reversals

Filters false RSI signals

Works in trending and ranging markets

Suitable for intraday and higher timeframes

Helps identify pullbacks within strong trends

Conclusion

The RSI Divergence Indicator for MT4 enhances the traditional RSI by combining overbought/oversold conditions with divergence analysis. This provides traders with clearer insight into potential market reversals and momentum shifts.

While highly effective, it performs best when combined with price action, Support And Resistance levels, and overall market structure analysis.

It is free to download, easy to install, and suitable for both beginners and advanced forex traders.