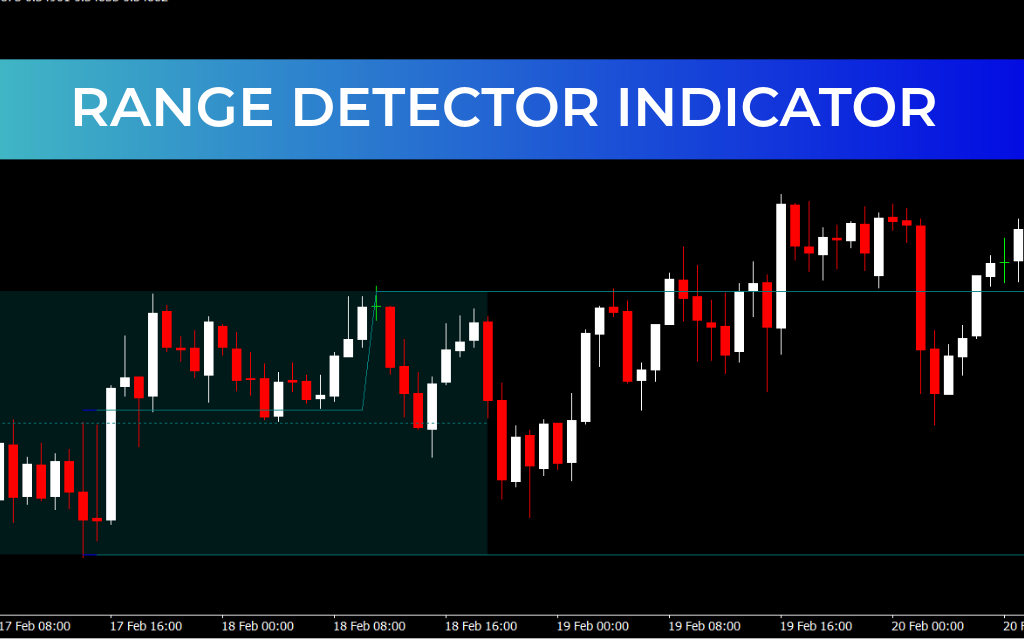

LuxAlgo Range Detector Indicator for MetaTrader 4 – Identify Consolidation Zones Before the Breakout

The LuxAlgo Range Detector Indicator for MetaTrader 4 is a specialized tool built to automatically detect horizontal price consolidation zones, commonly known as trading ranges.

These ranges occur when the market moves sideways and neither buyers nor sellers gain clear control. Since strong breakouts often follow periods of reduced volatility, identifying consolidation early gives traders a significant advantage.

This indicator is ideal for:

Breakout traders preparing for explosive moves

Mean-reversion traders trading range boundaries

Volatility-based strategies

Market Structure analysis

By visually marking ranges and labeling breakout direction, it simplifies decision-making and improves timing.

How the Range Detector Indicator Works

The indicator identifies when price remains within a defined horizontal boundary for a specified number of candles. Once confirmed, the area is:

Shaded directly on the chart

Marked as a valid consolidation range

🔵 Bullish Breakout

When price breaks above the upper boundary with strong momentum, the range is classified as “broken upward.”

This suggests:

Bullish continuation

Possible start of a new trend

Increased volatility

🔴 Bearish Breakout

When price closes below the lower boundary with momentum, the range is marked as “broken downward.”

This indicates:

Bearish pressure

Potential Trend Reversal

Downward expansion phase

Detecting False Breakouts

One of the key strengths of this indicator is its ability to identify:

Failed breakouts

False signals

Re-entries into the range

If price breaks out but quickly returns inside the range, it may signal a Liquidity Grab or weak momentum. This feature helps traders avoid low-quality setups and reduces the risk of being trapped in choppy market conditions.

Why Consolidation Zones Matter

Extended, unbroken ranges often indicate:

Market indecision

Low liquidity

Pre-news compression

Institutional accumulation or distribution

These environments frequently precede strong directional moves, making range detection essential for anticipating volatility expansion.

Best Trading Applications

✔ Breakout trading strategies

✔ Range-bound trading setups

✔ Scalping volatility expansions

✔ Smart money structure analysis

✔ Algorithmic trading filters

Whether you trade manually or with automated systems, identifying clean consolidation zones improves entry accuracy and risk management.

Conclusion

The LuxAlgo Range Detector Indicator for MT4 is a powerful tool for spotting consolidation zones and preparing for high-probability breakouts.

By visually defining horizontal ranges and detecting real-time breakout direction, it enhances:

Market structure clarity

Entry precision

Risk control

Volatility anticipation

Whether you're a breakout trader, range trader, or system developer, this indicator provides a valuable edge in identifying when the market is coiling — and when it’s ready to move.