FX Dzier Robot EA for MT4 is designed for traders who seek consistent growth and are comfortable using a controlled grid-based system. Unlike scalpers or high-frequency bots, this EA stacks trades in wave-like sequences while maintaining careful management of equity and drawdown. It thrives during ranging-trending transitions and rewards disciplined users with long-term balance growth.

During evaluation, I noticed FX Dzier EA demonstrates smart entry logic, steady balance growth, and effective drawdown control, particularly optimized for EURUSD on M30 and H1 charts. Backtests spanning multiple years show consistent performance, making it a reliable option for portfolio-based automated trading.

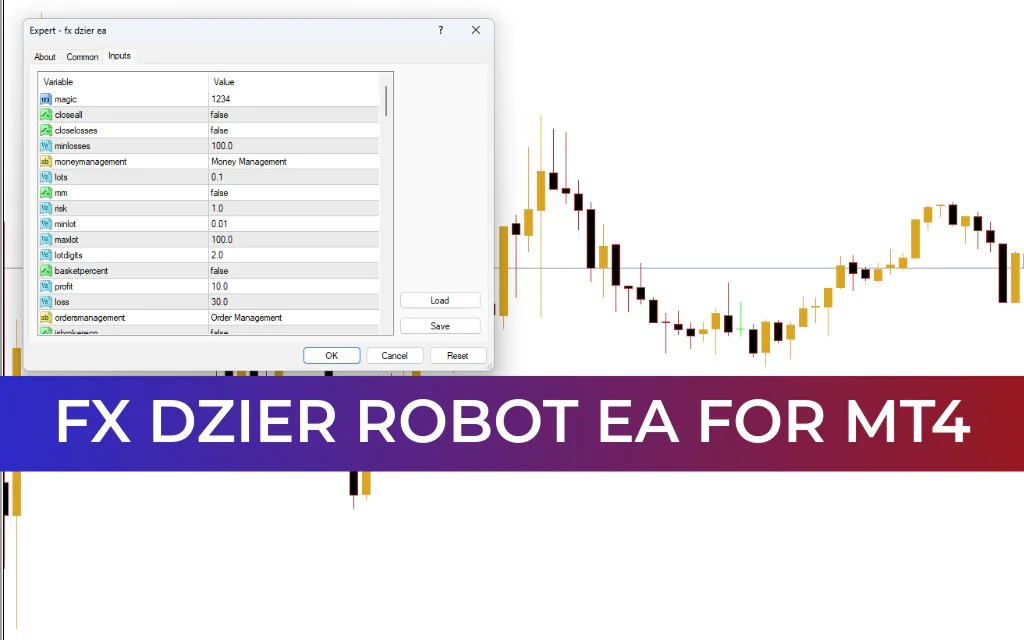

Recommended Settings

Currency Pairs: EURUSD (primary), GBPUSD (caution advised)

Timeframes: M30 or H1

Minimum Deposit: $1,000 (optimal $2,000+)

Leverage: 1:100 or higher

Account Type: ECN or Raw Spread accounts with tight execution

Key Features of FX Dzier Robot EA

Grid-based entry and recovery with adjustable step and lot multiplier

Trend-sensitive filters to reduce exposure during strong breakouts

Fixed stop-loss and take-profit on initial positions

Auto lot sizing based on balance and risk percentage

Multiple take-profit and breakeven exit management

Clean and fast execution on EURUSD

No classic martingale—lot increases are strictly controlled

How FX Dzier Robot EA Works

FX Dzier EA follows a trend-continuation grid approach. Initial trades are based on momentum or reversal breakouts, followed by calculated recovery trades during temporary pullbacks. The EA also:

Closes partial positions during rebounds while maintaining grid continuity

Limits drawdowns through precise step and volume adjustments

Provides a smooth equity curve with occasional recoverable dips

This approach ensures balance growth without risking account-breaking losses.

Trading Signals

The EA generates trades automatically when price reaches critical zones based on recent volatility and candle structure:

Buy signals: After downward spikes followed by failed breakdowns

Sell signals: After exhaustion rallies or Trend Continuation breakdowns

Recovery trades: Added at defined grid intervals with optional lot increase

Exits: Fixed TPs, trailing logic, or breakeven clusters

FX Dzier avoids random trades and reacts only to Market Structure. All signals appear clearly on the chart with TP/SL markers and ID numbers for easy tracking.

Conclusion

FX Dzier Robot EA is best suited for traders who understand grid trading mechanics and can tolerate floating drawdowns for long-term growth. It offers controlled execution, smart recovery logic, and strong equity performance on EURUSD. While temporary dips occur, the EA is designed to recover safely without extreme leverage or risky martingale.

In the hands of a disciplined and patient trader, FX Dzier EA can become a core component of a diversified automated trading portfolio.