Currency Strength Meter Indicator for MT4 – Identify the Strongest and Weakest Currencies

One of the limitations of the MetaTrader 4 platform is that it does not include a built-in tool to compare the relative strength of currencies.

To solve this problem, traders use the Currency Strength Meter Indicator — a powerful tool that measures and compares the strength of currencies in real time.

This helps traders quickly identify:

✔ Strong currencies

✔ Weak currencies

✔ Market dominance

✔ Correlations between currency pairs

With this information, traders can make smarter trading decisions.

What Is the Currency Strength Meter Indicator?

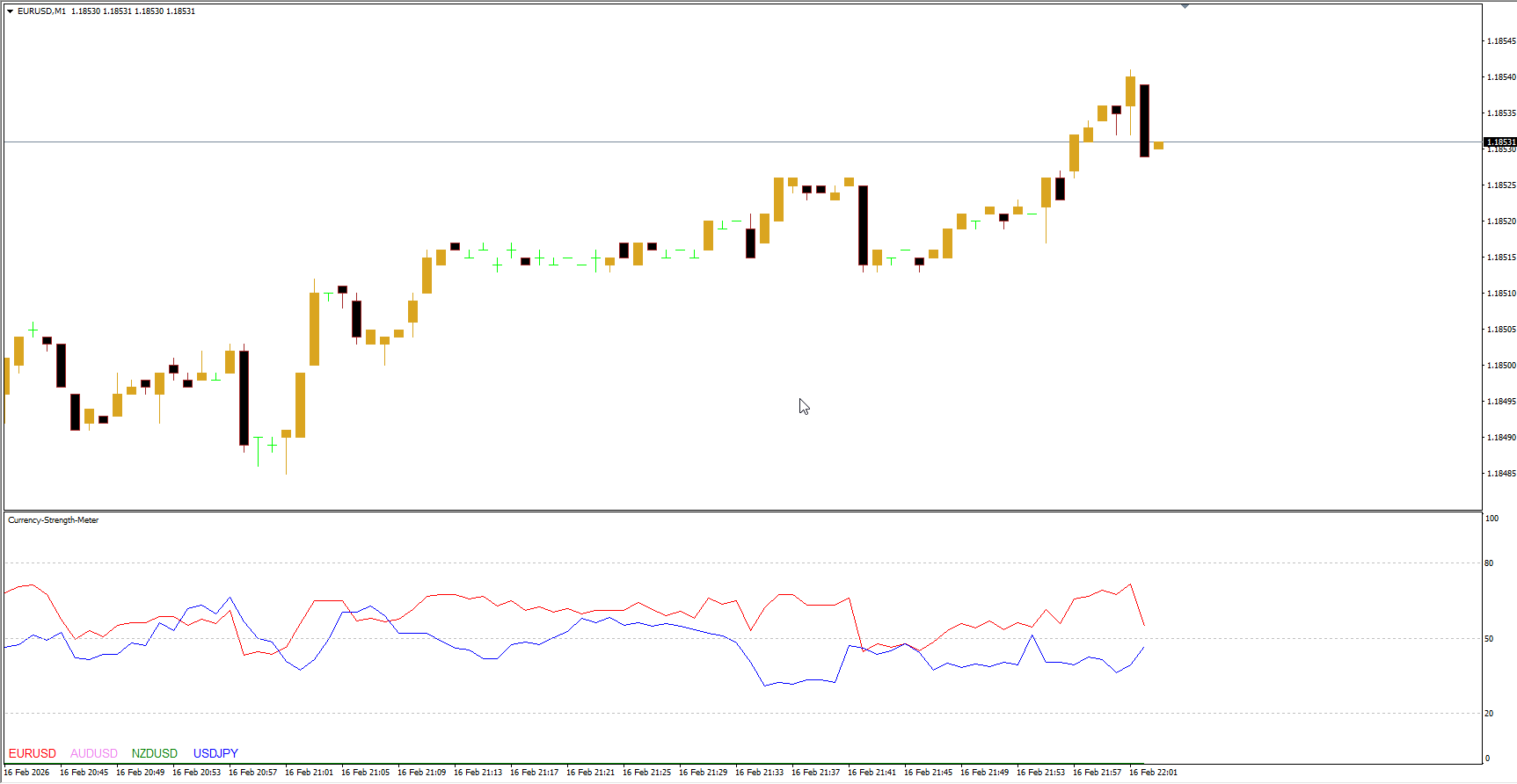

The Currency Strength Meter analyzes multiple currency pairs simultaneously and displays the relative strength of currencies on a scale from 0 to 100.

It builds several live charts and visually shows how strong or weak a currency is compared to another.

Understanding the Strength Scale

Near 100 → Base currency is strong, quote currency is weak (bullish move)

Near 0 → Quote currency is strong, base currency is weak (bearish move)

Around 50 → No clear strength advantage, neutral market

Understanding Base and Quote Currency

Every forex pair has two currencies:

Base currency → First currency (e.g., EUR in EUR/USD)

Quote currency → Second currency (e.g., USD in EUR/USD)

If the strength meter rises toward 100, the base currency is gaining power over the quote currency.

Key Features of the Currency Strength Meter

1. Real-Time Currency Strength Comparison

The indicator displays live strength values for multiple currencies at once.

This helps traders see which currency is dominating the market.

2. Built-In Correlation Insight

Currency correlation shows whether pairs move:

In the same direction (direct correlation)

In opposite directions (inverse correlation)

Example:

One pair near 80 and another near 20 → strong inverse correlation

Both moving similarly → direct correlation

Instead of checking correlation tables online, you can monitor it directly on the indicator.

3. Multi-Chart Analysis in One Window

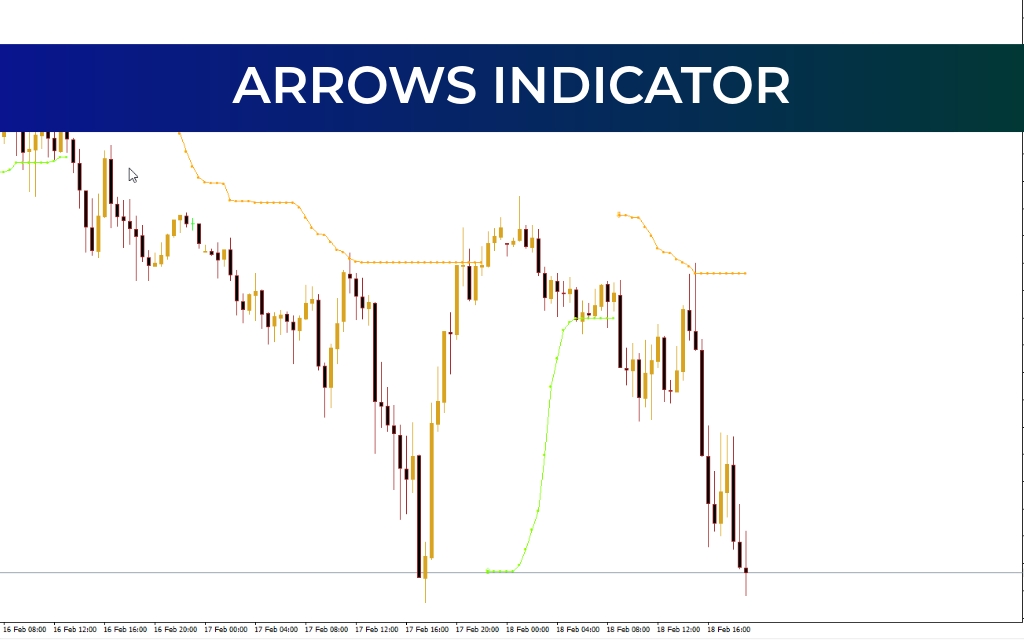

The indicator displays several currency pair charts simultaneously, making comparison faster and easier.

Colors of charts match ticker labels for quick recognition.

4. Market Demand Visualization

The indicator helps identify which currency is currently most in demand among traders.

This is extremely useful for building trend-following strategies.

How to Use the Currency Strength Meter

This indicator does not give direct buy or sell signals.

Instead, it provides market positioning insight.

Example Market Analysis

If:

EUR/USD above 50

GBP/USD above 50

NZD/USD above 50

This means EUR, GBP, and NZD are strong vs USD.

If:

USD/CAD below 50

This confirms USD weakness against CAD.

👉 Conclusion: USD is broadly weak across the market.

This type of analysis helps traders choose better trading opportunities.

Timeframe Priority When Using the Indicator

Higher Timeframes

✔ Less market noise

✔ More reliable signals

✔ Fewer trade opportunities

Lower Timeframes

✔ More trade setups

✔ Higher volatility

✔ More false signals

For best results, many traders analyze strength on higher timeframes first.

Tips for Using the Indicator Efficiently

Some traders initially find multiple charts confusing.

You can simplify the display by:

✔ Reducing number of pairs shown

✔ Adjusting line thickness

✔ Changing visual styles

After customization, reading currency strength becomes much easier.

Advantages of the Currency Strength Meter

✔ Identifies strongest and weakest currencies

✔ Shows market dominance instantly

✔ Reveals correlations between pairs

✔ Improves trade selection

✔ Supports multi-pair analysis

✔ Works in real time

✔ Enhances strategic planning

Who Should Use This Indicator?

The Currency Strength Meter is ideal for:

✔ Trend traders

✔ Multi-pair traders

✔ Strength-based strategies

✔ Fundamental traders

✔ Professional forex traders

✔ Beginners learning currency relationships

Final Thoughts

The Currency Strength Meter is one of the most practical analytical tools for MT4 traders.

Instead of guessing which currency is strong or weak, you can measure it objectively.

This allows you to:

Trade stronger currencies

Avoid weak trends

Improve pair selection

Build data-driven strategies

Once configured properly, it becomes an essential part of many professional trading systems.