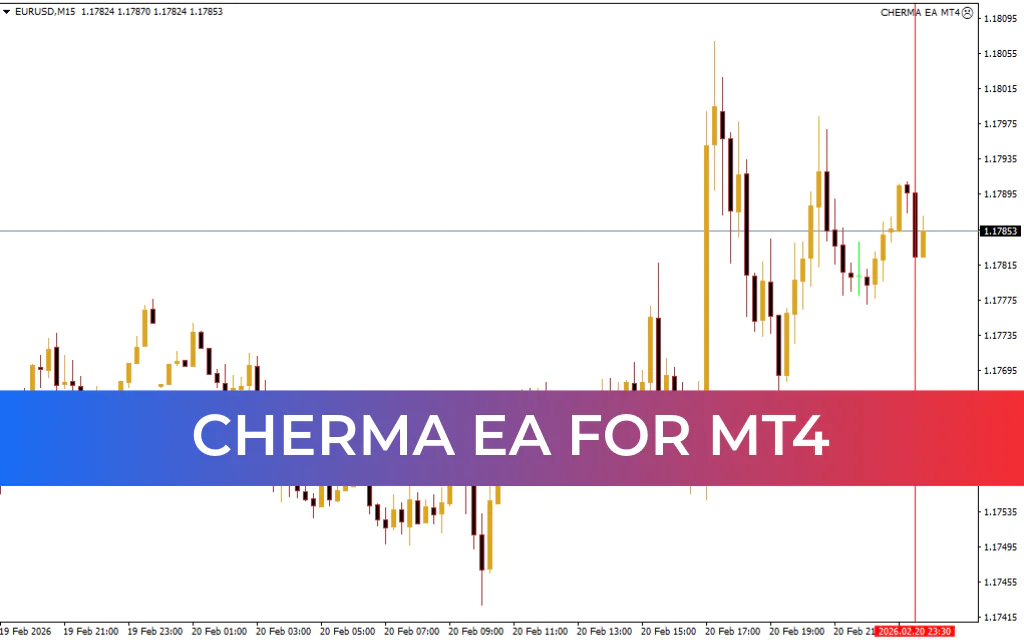

CHERMA EA Review: Trend-Focused Gold Trading on MT4

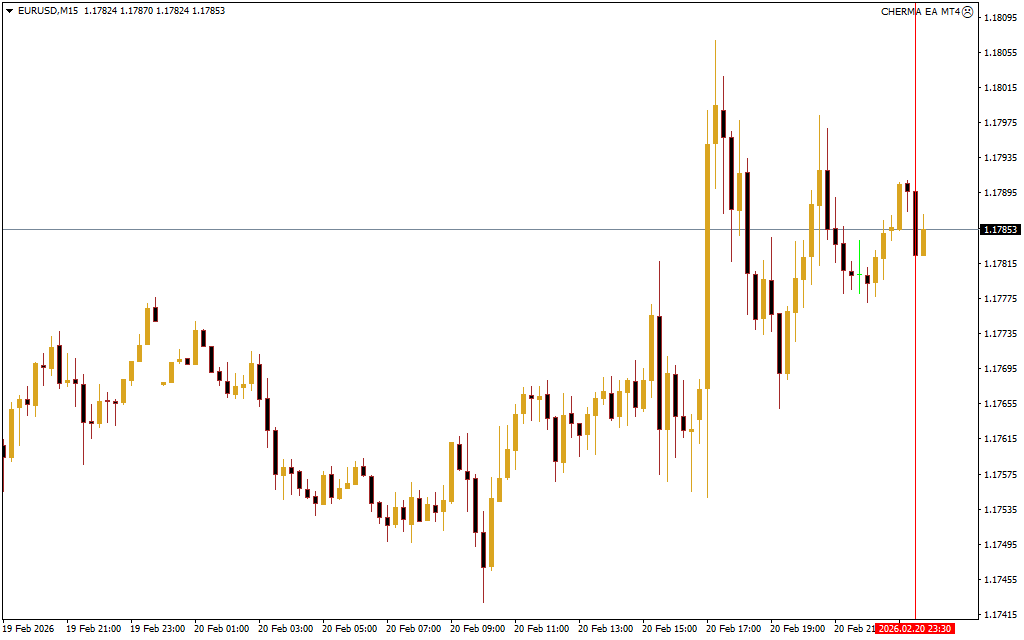

CHERMA EA for MT4 is an automated trading system designed to capture clear directional movements with high accuracy while maintaining efficient drawdown control. During extensive testing, I observed that the EA performs best in strong trending environments, while remaining cautious and stable during less favorable market periods. Its balanced approach makes it suitable for both experienced traders and those seeking a structured, long-term automated strategy without excessive risk.

Recommended Settings for CHERMA EA

For optimal performance, trade XAUUSD on the M5 timeframe with a minimum deposit of $500 and leverage of 1:500 or higher. ECN or Raw Spread accounts are recommended to ensure tight execution and minimal transaction costs. These settings allow the EA to follow strong trends effectively without interruptions from spread spikes or execution delays.

Key Features of CHERMA EA

CHERMA EA offers a robust set of features that prioritize accuracy and risk management:

Trend-following algorithm: focuses on capturing directional price movement.

Dynamic risk control: adjusts lot sizing and trade exposure based on volatility.

Drawdown protection: limits equity damage during unexpected reversals.

No martingale or grid: keeps risk contained and predictable.

Spread and slippage filter: ensures high-quality entries.

Fully automated with manual override options for control.

During testing, the EA showed remarkable stability in clean trends, avoiding excessive order stacking and emotional decision-making while maintaining structured, rule-based execution.

Trading Strategy

CHERMA EA uses a multi-layered trend-following strategy that combines higher timeframe trend analysis with lower timeframe triggers for precise entries. In strong bullish or bearish trends, it builds positions methodically, using trailing stops and structured exits to secure profits. In sideways or choppy conditions, trading activity is reduced, preventing unnecessary drawdowns. This deliberate pacing sets CHERMA EA apart from high-frequency Scalping systems that struggle in flat markets.

Trading Signals

The EA generates trades when momentum indicators and price action confirm a clear directional bias, spreads and volatility meet optimal thresholds, and session filters (London & New York) are favorable. Every trade uses fixed Stop Loss and Take Profit levels, while dynamic trailing stops lock in profits as trends extend. Unlike many automated systems, CHERMA does not rely on martingale or recovery methods, keeping its risk profile predictable and manageable.

Conclusion

CHERMA EA for MT4 is a well-structured, trend-focused Expert Advisor combining precision, strong risk management, and steady performance. Its strengths include exceptional performance in trending markets, stable drawdowns, high-quality entries, and a simple, logical strategy. Weaknesses include reduced activity during flat markets, which may limit opportunities for profit. Overall, CHERMA EA is ideal for traders seeking a disciplined, trend-following gold trading system that prioritizes safety and consistent growth.