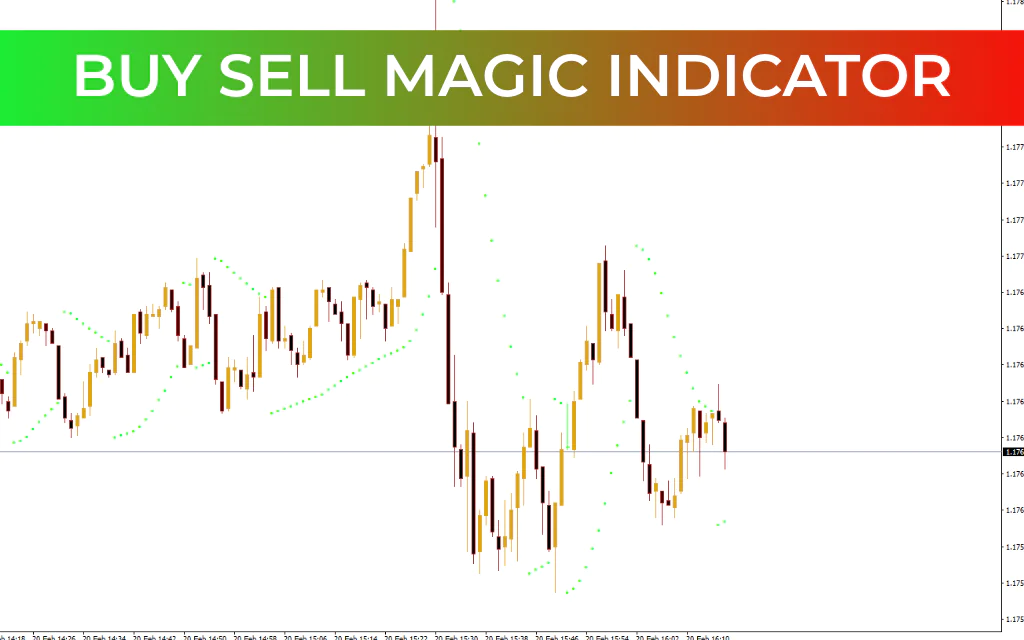

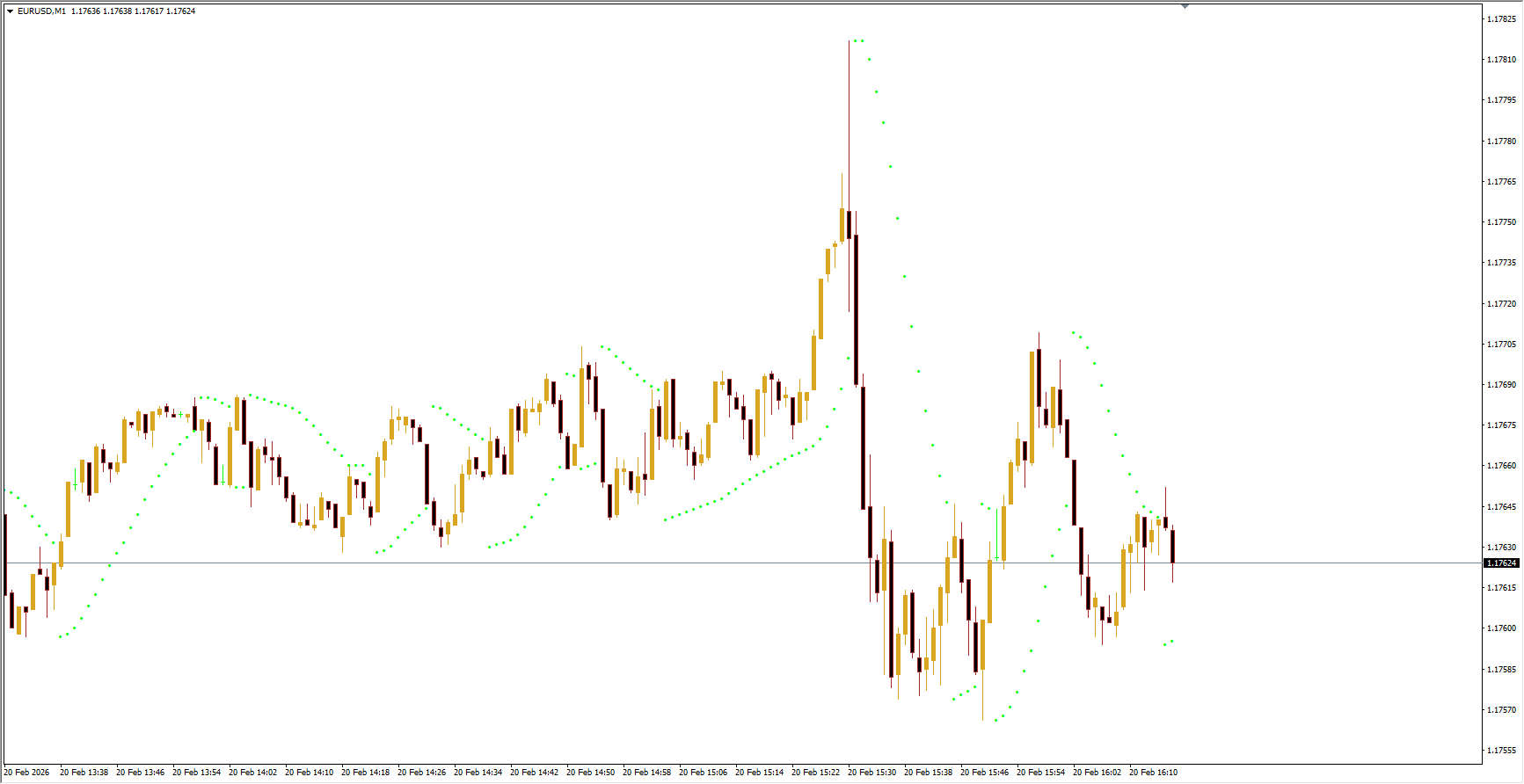

The Buy Sell Magic Indicator is a custom trend-following tool designed to help forex traders identify clear buy and sell opportunities. It provides precise entry and exit signals and is known for being non-repainting, meaning its signals remain fixed once they appear. While it visually resembles the Parabolic SAR and behaves in a similar way, it uses a different calculation method. Its primary purpose is to analyze and track trending market conditions.

This indicator is plotted directly on the price chart and functions somewhat like a fast-reacting moving average. However, unlike traditional moving averages, it adjusts more aggressively to price changes and can rapidly shift position as market momentum changes.

How to Use the Buy Sell Magic Indicator

In an uptrend, the indicator line appears below the price.

In a downtrend, the indicator line appears above the price.

When price crosses the indicator line, the indicator flips to the opposite side of the chart. This reversal signals either a trend correction or a complete Trend Reversal. The new reference point is typically based on the previous period’s high or low.

The Buy Sell Magic indicator is also widely used as a trailing stop tool:

Close buy trades if price drops below the indicator line.

Close sell trades if price rises above the indicator line.

When a trade is active, the indicator line continues moving in the direction of the trend, adjusting according to price movement strength.

Buy Sell Magic Trading Strategy

Long (Buy) Strategy

Wait for the indicator line to shift below the price.

Confirm with a bullish candle close.

Enter the trade after the candle closes.

Place stop-loss near recent swing lows.

Exit when the indicator flips above the price.

Short (Sell) Strategy

Wait for the indicator line to shift above the price.

Confirm with a bearish candle close.

Enter the trade after the candle closes.

Place stop-loss near recent swing highs.

Exit when the indicator flips below the price.

Conclusion

The Buy Sell Magic Indicator is a practical technical tool that helps traders identify optimal trade entries and exits in trending markets. It also functions effectively as a trailing stop mechanism. However, like any trading method, it carries risk. For improved accuracy and risk management, traders should confirm signals with additional indicators or Price Action analysis.