Successful forex traders know that placing stop losses at the right levels is essential for protecting profits and managing risk. The ATR Trailing Stop Indicator for MetaTrader 4 leverages the Average True Range (ATR) to calculate market volatility and provide traders with precise trailing stop loss levels.

This indicator is widely used by both manual and automated traders, offering dynamic Support And Resistance levels that move with the market, allowing traders to ride trends confidently while minimizing losses.

Why Use ATR Trailing Stop Indicator

Calculates trailing stops based on market volatility using ATR.

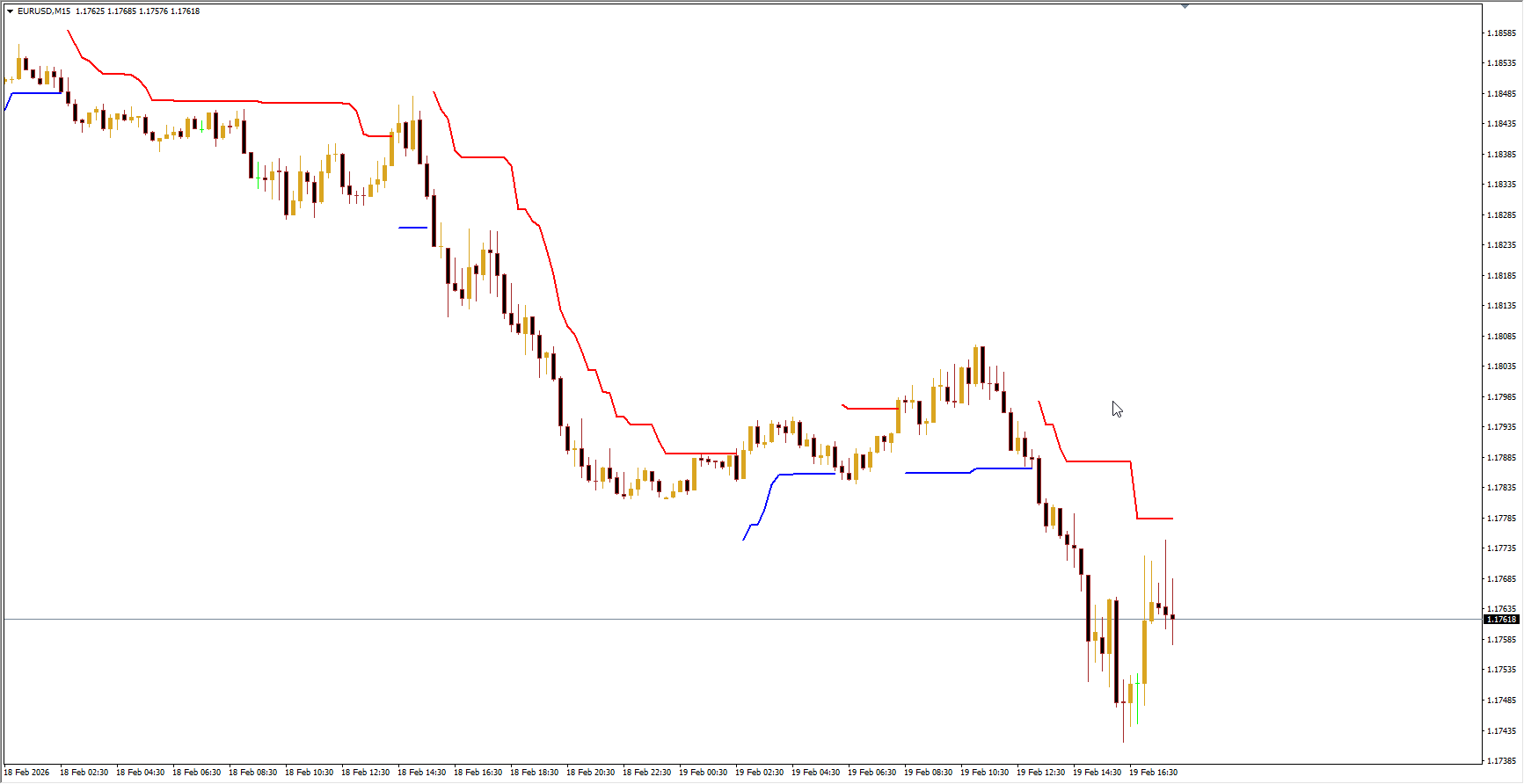

Provides clear entry and exit signals with color-coded lines:

Blue line → bullish trend / buy signal

Red line → bearish trend / sell signal

Helps traders understand Trend Strength and market volatility.

Compatible with other technical indicators and Price Action strategies for confirmation.

How to Trade with ATR Trailing Stop

Identify Trend Direction:

Enter a buy trade when the trailing stop line turns blue.

Enter a sell trade when the trailing stop line turns red.

Ride the Trend:

Stay in your position until the trailing stop reverses color, signaling an exit.

On charts like GBPJPY H1, the ATR trailing stop can act as a dynamic support/resistance level, helping traders hold positions confidently through consolidations.

Combine with Other Indicators:

Use moving averages, RSI, or price action patterns to confirm trade entries and exits.

Adjust the ATR multiplier to optimize the indicator for different currency pairs and timeframes.

Additional Recommendations

For traders exploring similar volatility-based tools, the BBand Stop Alert Indicator and the WATR Indicator are excellent complements, each offering unique approaches to refining trailing stop strategies.

Conclusion

The ATR Trailing Stop Indicator for MT4 is ideal for both beginner and experienced forex traders. Beginners benefit from clear, intuitive signals and volatility snapshots, while seasoned traders can use it to fine-tune trailing stops, identify trend direction, and optimize entry and exit points. Its integration with other technical strategies makes it a versatile tool for any trading plan.