RSI EA for MetaTrader 4 is a fully automated trading system built on the Relative Strength Index (RSI) indicator. This Expert Advisor detects overbought and oversold market conditions and executes trades automatically according to predefined rules. Designed to save time and reduce emotional trading, RSI EA adapts to multiple currency pairs and timeframes, delivering both stability and profitability.

Whether you’re a beginner or an experienced trader, this EA provides disciplined execution and reliable automation for short-term reversals.

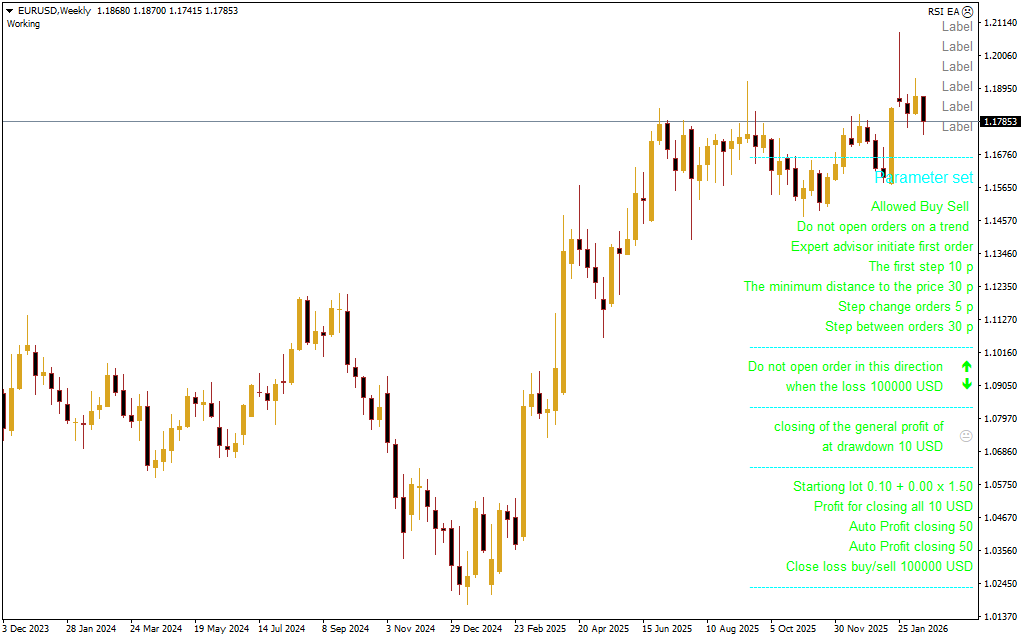

Recommended Settings for RSI EA

Currency Pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, XAUUSD

Timeframe: M15 (recommended)

Minimum Deposit: $200–$500 depending on risk tolerance

Leverage: 1:100 or higher

Account Type: Standard or ECN accounts with low spreads

Pairs with stable liquidity like EURUSD and GBPUSD typically produce smoother results, while XAUUSD requires more conservative risk settings due to higher volatility.

Key Features of RSI EA for MT4

Automated Buy & Sell Orders: Executes trades based on RSI levels.

Customizable RSI Levels: Adjust oversold/overbought thresholds to suit your strategy.

Risk Management: Includes stop-loss, equity protection, and auto profit closing.

Step-Based Order Management: Optimizes trade entries and reduces overtrading.

Equity Protection Logic: Safeguards capital during volatile market conditions.

Simple Setup: Easy to attach to charts and begin automated trading.

Strategy Overview

The RSI EA leverages one of the most widely used technical indicators, the Relative Strength Index.

Buy Signals: Triggered when RSI drops below the oversold level (commonly 30), anticipating an upward price reversal.

Sell Signals: Triggered when RSI rises above the overbought level (commonly 70), anticipating a downward correction.

Optimized Trade Management: Step-based adjustments, grid-style entries, automatic take-profit, and stop-loss ensure trades are executed efficiently while controlling risk.

This strategy focuses on short-term market reversals and ensures disciplined execution, reducing losses during unfavorable trends.

Trading Signals

RSI EA generates clear, actionable trading signals:

Opens buy trades during oversold conditions and sell trades during overbought conditions.

Monitors price distance and step changes to avoid market noise.

Integrates auto profit-taking and equity protection to lock in gains and limit losses.

The result is a reliable automated system capable of delivering consistent results with minimal manual intervention.

Conclusion

RSI EA for MT4 is a powerful automated tool for traders seeking disciplined, reliable trading based on the RSI indicator. With adaptive risk management, step-based trade logic, and equity protection, it offers both beginners and professional traders a way to capture short-term market reversals efficiently. For those looking to automate their trading and reduce emotional decision-making, RSI EA is a smart addition to any MT4 portfolio.