Lucky Reversal Indicator – A Powerful Tool for Confirming Trend Changes

Trend reversals are a natural part of the Forex market. Wherever trends exist, reversals will follow. Many trading strategies are built around this simple principle — identify when a trend changes direction and position yourself to profit from the new move.

The challenge for traders is choosing the right tools to detect these changes and trade effectively. The Lucky Reversal Indicator is one such tool, designed to help traders identify and confirm market reversals. While there are many reversal indicators available, this one offers several unique characteristics that set it apart.

What Is a Good Reversal Indicator?

The Lucky Reversal Indicator does exactly what its name suggests — it signals when a market trend changes from up to down or from down to up.

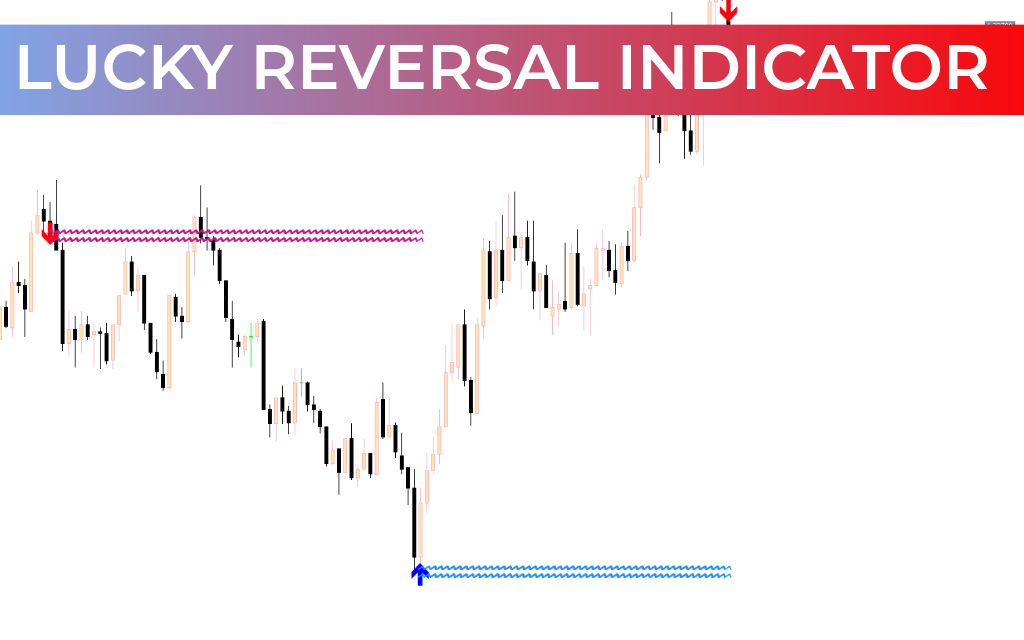

It displays clear visual signals on the chart:

Blue arrows indicate the start of an uptrend

Red arrows indicate the beginning of a downtrend

Wavy horizontal lines appear after each signal, marking the projected trend direction

These simple visual cues make the indicator easy to interpret, even for traders who prefer clean charts without clutter.

The Major Flaw of the Lucky Reversal Indicator

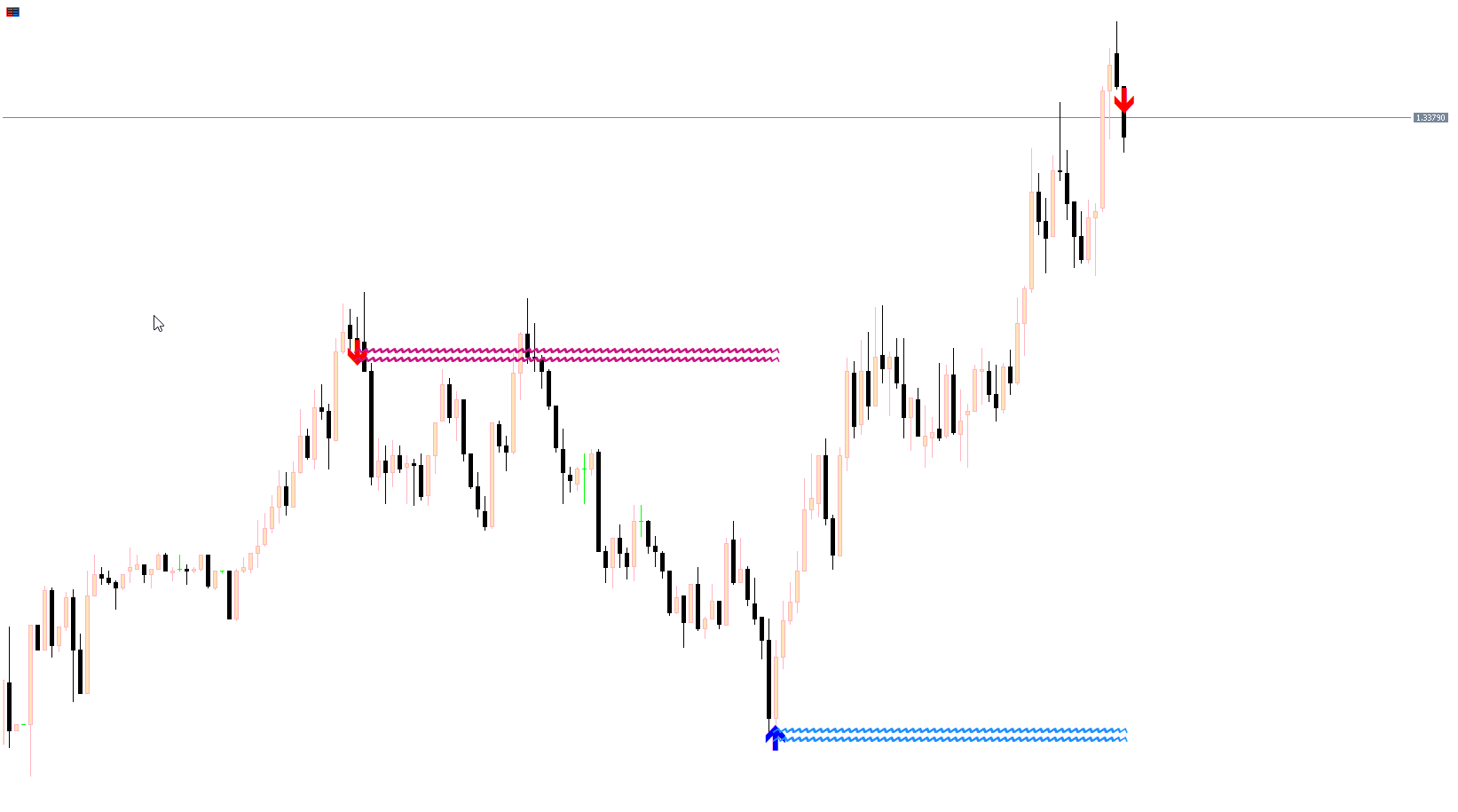

The Lucky Reversal Indicator differs from many other reversal tools because it is a lagging indicator. This means it confirms reversals after they occur rather than predicting them in advance.

Many traders initially try to use it to catch reversal breakouts — which often leads to frustration. During backtesting, signals appear to align perfectly with major highs and lows, giving the impression that the indicator predicts turning points.

However, in live market conditions, signals appear only after the reversal is confirmed. The arrow is plotted when the market has already changed direction, not when the move first begins.

Because of this delay, the indicator is not suitable for traders who want to capture the exact turning point of a reversal.

The Strength of the Lucky Reversal Indicator

Interestingly, the indicator’s biggest weakness is also its greatest strength.

Since it confirms reversals rather than predicting them, it helps traders avoid false signals and premature entries. Instead of guessing when a trend will change, traders can use the indicator to confirm that a new trend is already in motion.

For example, once the market reverses from a downtrend into an uptrend and the indicator confirms it, traders can confidently trade the continuation of that new trend.

Lucky Reversal Indicator Trading Strategies

The most effective way to use the Lucky Reversal Indicator is as part of a broader trading system. It works best when combined with other tools such as:

Support And Resistance levels

Chart patterns

Moving averages

Other trend-following indicators

Using multiple confirmations helps improve trade accuracy and risk control.

Trade Management

Proper trade management is essential when using any indicator.

Take Profit

Set clear price targets in advance. Avoid waiting for the indicator to produce an opposite signal before exiting a trade.

Stop Loss

Never risk more than you can afford to lose. A common guideline is to risk no more than 2% of trading capital per trade.

The indicator’s wavy lines can sometimes help define stop-loss levels, as price rarely crosses them once they are drawn. However, this method may not always provide the best risk-to-reward ratio.

Who Is the Lucky Reversal Indicator Best For?

The Lucky Reversal Indicator is most suitable for:

Intermediate and professional traders

Trend-following traders

Traders who understand lagging indicators

Beginner traders can also use it, but they should first understand how trend reversals work and how confirmation indicators behave.

Overall, the indicator is best for traders who focus on trend confirmation rather than early reversal prediction.

Bottom Line

The Lucky Reversal Indicator is a reliable confirmation tool for identifying trend changes in the Forex market. While it cannot predict reversals at their earliest stage, it excels at confirming when a new trend is already underway.

By combining it with other technical tools and applying proper risk management, traders can use it to improve trade timing and confidence. For trend-following strategies, it can be a valuable addition to any trading system.