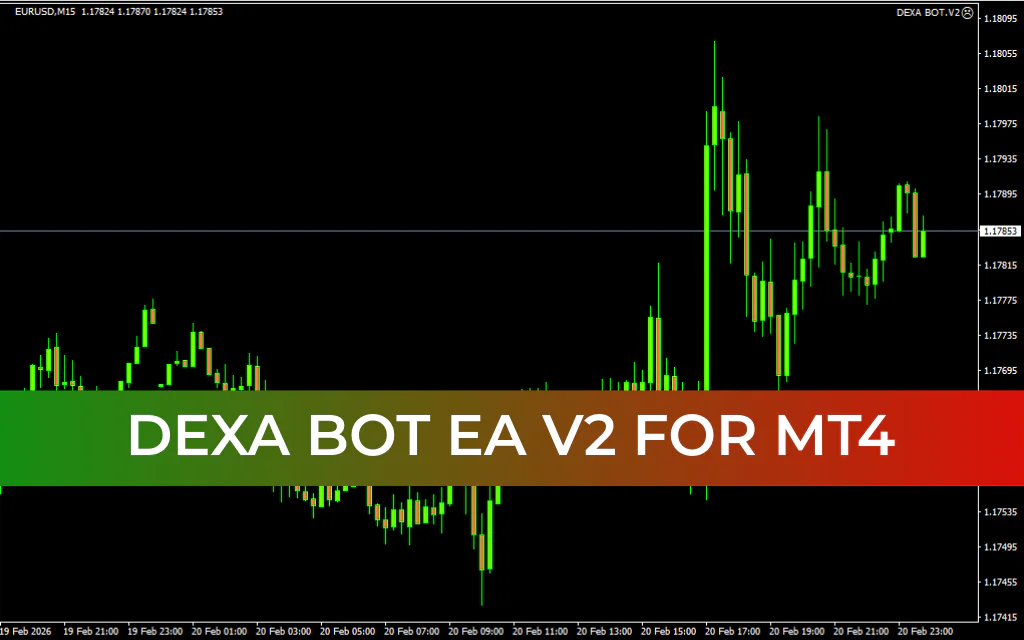

DEXA BOT EA V2 Review: Versatile Trend Trading on MT4

DEXA BOT EA V2 is a versatile and well-structured tool for algorithmic trading on MetaTrader 4. After several weeks of testing across multiple brokers, timeframes, and market conditions, I found its performance consistent and reliable. While primarily designed for trending markets, the EA includes flexible parameters and advanced risk management modules that allow it to adapt to a wide range of trading environments. It is not a “set and forget” system, but when used with proper configuration and disciplined strategy, it can deliver steady results with moderate risk.

Recommended Settings for DEXA BOT EA V2

For optimal performance, trade EURUSD, GBPUSD, or USDJPY on the M15 to H1 timeframes. M15 offers more frequent signals, while H1 provides smoother and more stable equity curves. A minimum deposit of $300 for standard accounts is recommended, along with leverage of 1:200 or higher. ECN or Raw Spread accounts with fast execution are ideal for achieving precise entries. During testing, EURUSD on the H1 timeframe produced the most consistent results, and using a VPS significantly improved execution speed and reduced slippage.

Key Features of DEXA BOT EA V2

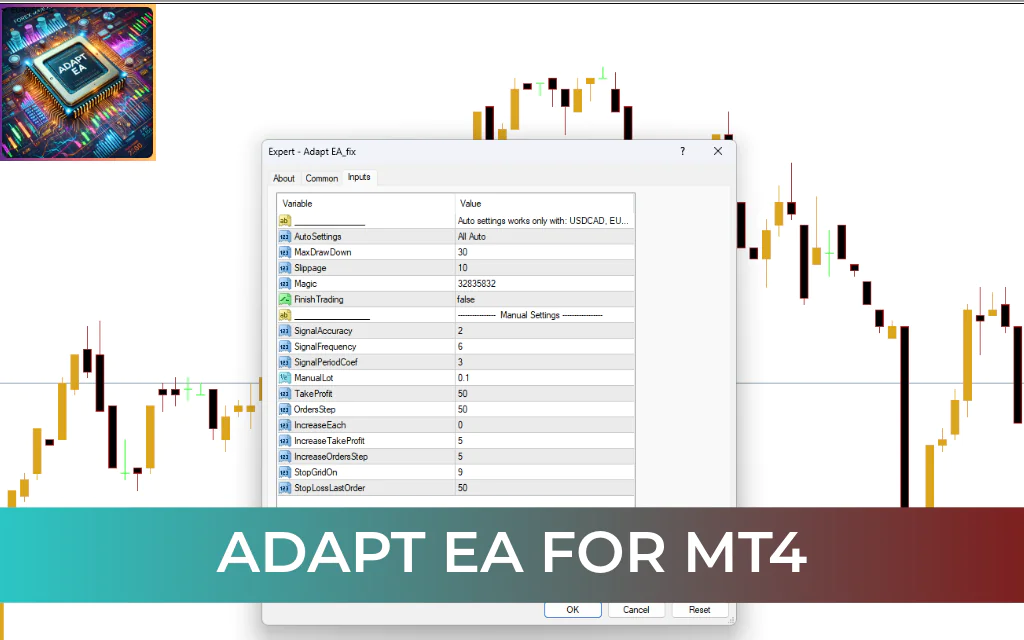

DEXA BOT EA V2 offers a strong set of features suitable for intermediate and advanced traders seeking structured automation:

- Trend-following engine that trades with the prevailing market direction.

- Smart lot progression system with dynamic or fixed position sizing options.

- Recovery module designed to gradually recover drawdowns without aggressive martingale.

- Built-in news filter to avoid high-impact market events.

- Equity protection system to limit drawdown and safeguard account balance.

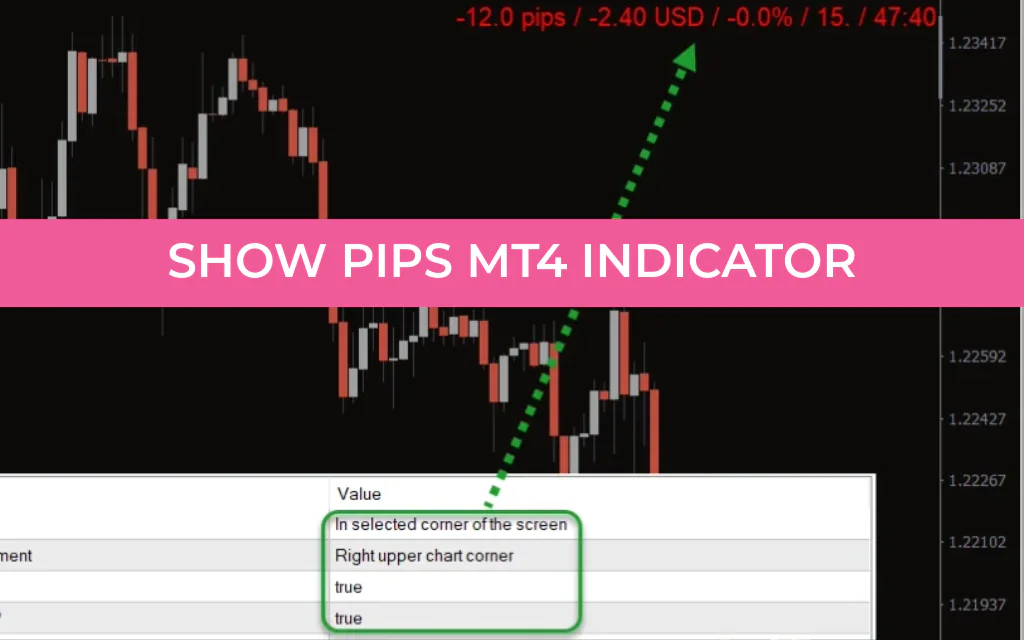

- Clear trading interface showing balance, equity, trade profit, and position details.

Unlike many grid-based systems, DEXA BOT EA V2 focuses on fewer, higher-quality trades aligned with trend direction rather than opening excessive positions.

Trading Strategy

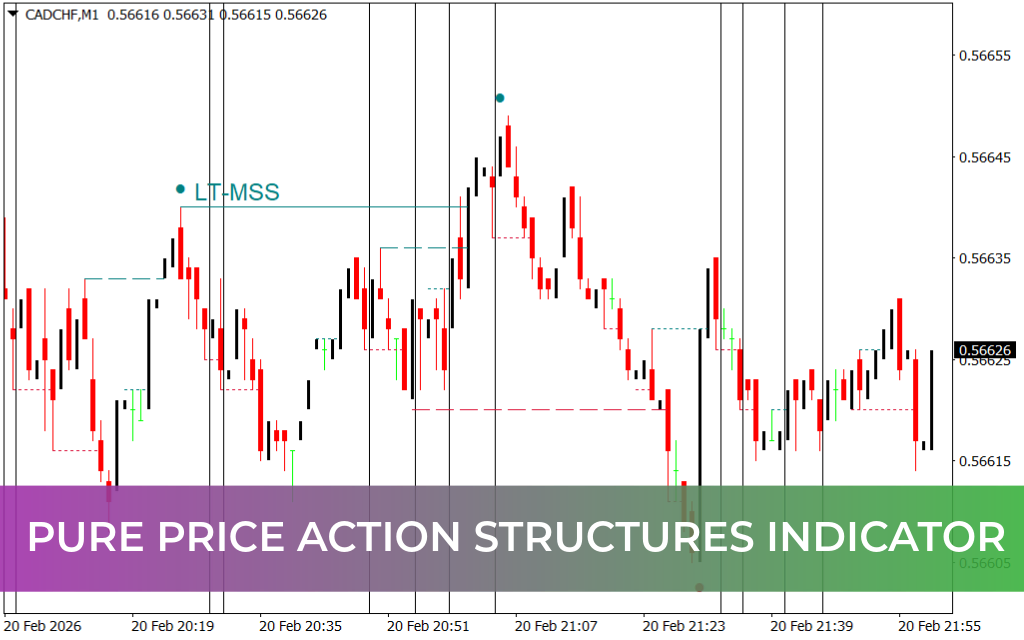

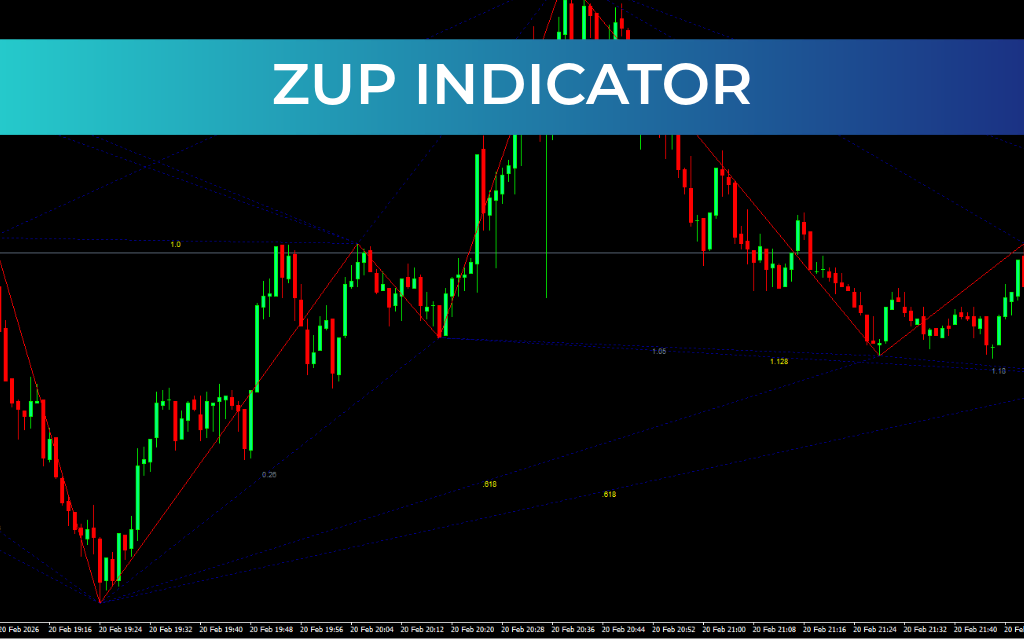

The strategy centers on identifying strong directional movement and trading within established trends. The EA detects key breakouts or pullback opportunities and executes trades with predefined stop loss and take profit levels. In trending markets, DEXA BOT EA V2 performs exceptionally well, generating consistent profits while maintaining low drawdown. During sideways or choppy conditions, trading activity decreases significantly, helping preserve capital. Its soft recovery mechanism allows gradual recovery from temporary drawdowns without using risky lot multiplication methods.

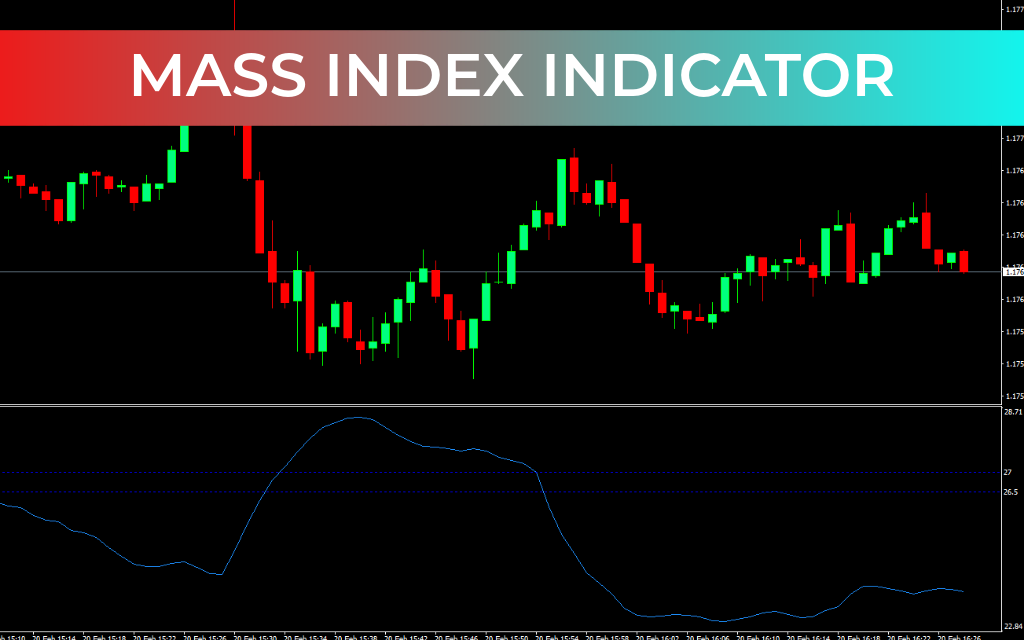

Trading Signals

DEXA BOT EA V2 generates trading signals based on breakouts of key support or resistance levels, trend confirmation filters including momentum and volatility, and favorable spread and session conditions. Each trade is protected with stop loss and managed with trailing stops once the position moves into profit, balancing risk protection with profit maximization.

Conclusion

After testing DEXA BOT EA V2 on both live and demo accounts, it stands out as a reliable trend-following Expert Advisor that delivers consistent performance when used correctly. Its strengths include excellent results in trending markets, stable equity growth from high-quality trades, and robust risk management features. Its limitations include reduced performance during flat market conditions and the need for a broker with low spreads and fast execution. DEXA BOT EA V2 is best suited for disciplined traders who value steady growth over high-frequency trading. When combined with proper risk management, a VPS, and a reliable broker, it can be a dependable component of a diversified trading portfolio.