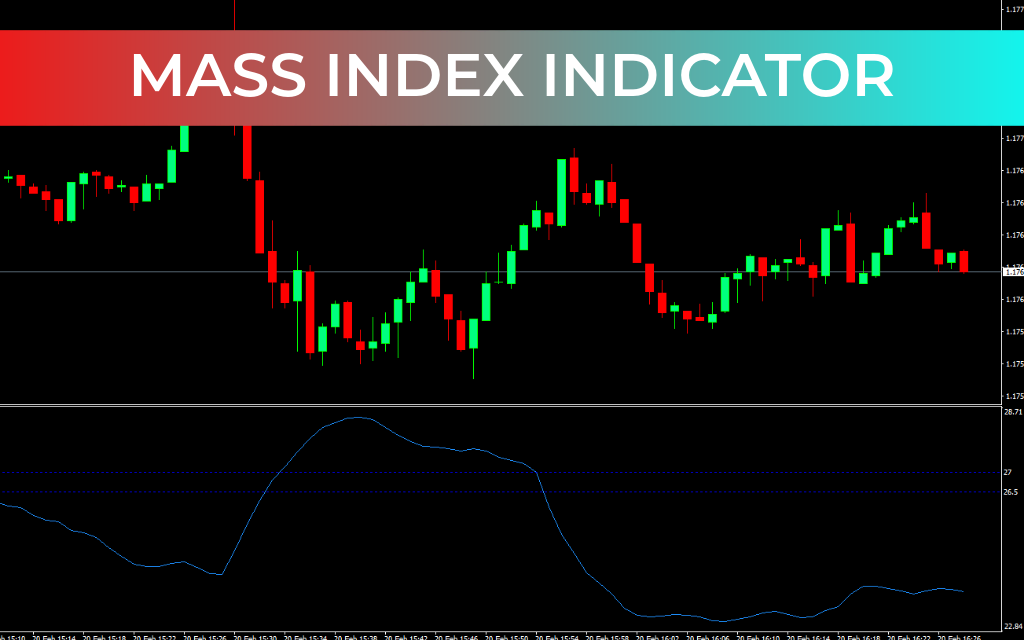

In the forex market, traders often say that “the trend is your friend,” and trading in the direction of the trend is generally considered safer. However, trends do not last forever. Identifying a Trend Reversal early can provide some of the most profitable trading opportunities. The Mass Index Indicator is a specialized technical tool designed to detect potential market reversals by analyzing changes in volatility and price range expansion.

Foundation of the Mass Index Indicator

The Mass Index Indicator for MT4 helps traders identify possible trend reversals by measuring the volatility and momentum of a currency pair. Instead of showing direction directly, it highlights when the market is likely preparing for a significant shift.

A key reversal signal, known as a reversal bulge, occurs when:

The indicator rises above 27, and

Then drops below 26.5.

When this pattern appears, it suggests that the current trend may be ending and a reversal could soon begin. Traders can then prepare to enter either long or short positions depending on Price Action confirmation.

How to Use the Mass Index Indicator

When a reversal bulge forms, traders should look for price action confirmation before entering a trade. Common confirming patterns include:

Bullish engulfing candle

Bearish engulfing candle

Pin bar

Doji candlestick

Example Trade Setup

If the indicator rises above 27 during a strong uptrend and later falls below 26.5, a reversal signal is generated. If a bearish engulfing candle appears afterward, traders may enter a sell trade, confirming the shift from an uptrend to a downtrend.

Risk Management

Place stop-loss near the recent swing high (for sell trades) or swing low (for buy trades).

Use a trailing stop to capture gains as the new trend develops.

Best Timeframes

The Mass Index Indicator works on all timeframes, but it is most effective on higher timeframes such as daily, weekly, and monthly charts, where trend reversals tend to be more reliable.

Conclusion

The Mass Index Indicator is a powerful and straightforward tool for identifying potential trend reversals in forex trading. While it can be used independently, it performs best when combined with price action analysis and other technical indicators such as moving average crossovers or MACD. By detecting volatility expansion before direction changes, it helps traders prepare for major market turning points and trade with greater confidence.