Dark Algo EA V2.0 Review: Adaptive Algorithmic Trading on MT4

Dark Algo EA V2.0 is a smart and adaptive Expert Advisor designed to operate with precision on the MetaTrader 4 platform. During extended testing, I evaluated how this EA performs across various market conditions, focusing on its ability to respond to both trending and ranging environments. What stood out most was its efficient position management and intelligent handling of spread conditions. Rather than using aggressive or high-risk strategies, Dark Algo EA V2.0 relies on calculated entries supported by technical filters, making it well suited for traders seeking stable and controlled performance.

Recommended Settings for Dark Algo EA V2.0

For optimal results, trade EURUSD, GBPUSD, and USDJPY on the H1 timeframe. A minimum deposit of $500 for standard accounts is recommended, along with leverage of 1:500 or higher for flexibility. ECN or Raw Spread accounts provide the best execution quality and lower transaction costs. These settings help ensure precise entries and smooth trade management.

Key Features of Dark Algo EA V2.0

Dark Algo EA V2.0 is designed for stability and long-term sustainability, offering several advanced features:

- Adaptive trading logic that responds to both trending and ranging market conditions.

- Smart spread control to avoid trades during unfavorable spread spikes.

- Drawdown protection system that pauses trading at predefined equity levels.

- Built-in technical filters including ADX, CCI, and Stochastic for signal confirmation.

- No martingale or grid strategies, reducing exposure to sudden reversals.

- VPS compatibility for fast execution and stable performance.

These features work together to create a disciplined and structured trading environment focused on risk control and consistent performance.

Trading Strategy

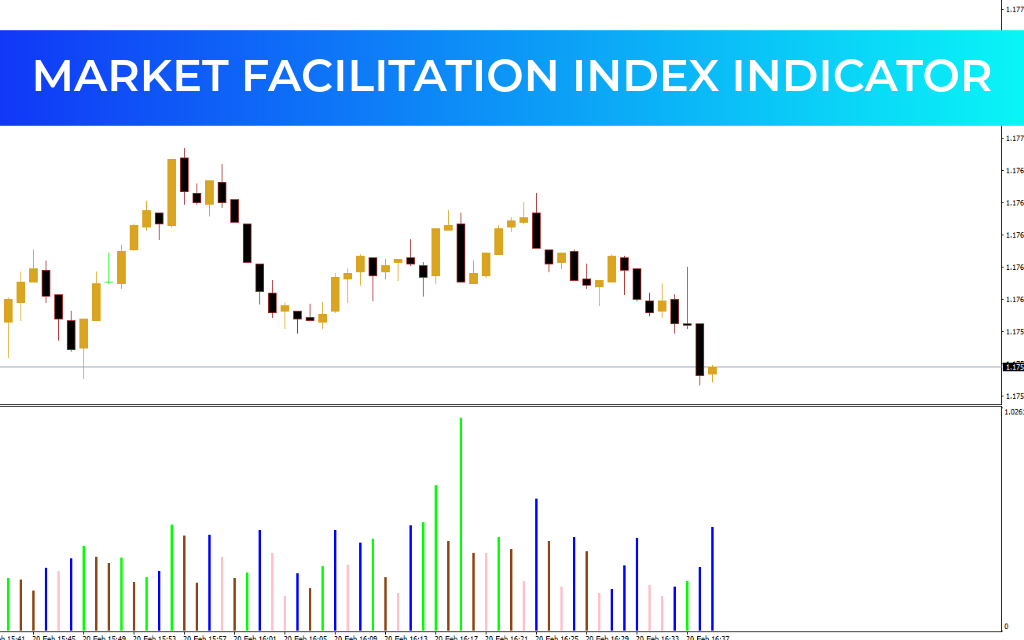

The core strategy of Dark Algo EA V2.0 is trend-following supported by adaptive confirmation filters. The algorithm identifies directional movement and verifies it using multiple technical indicators before executing trades. During strong trends, the EA performs particularly well by capturing smooth price movements. In sideways or low-volatility markets, it becomes more selective, reducing unnecessary exposure and preventing overtrading. Stop loss and take profit levels are calculated dynamically, allowing precise risk management tailored to market conditions.

Trading Signals

Dark Algo EA V2.0 generates signals based on ADX Trend Strength, CCI momentum confirmation, Stochastic timing, and real-time spread conditions. Each trade is opened with predefined Stop Loss and Take Profit levels, while trailing stop functionality helps secure profits as trades move favorably. Since the EA does not rely on grid or martingale methods, drawdowns remain moderate and easier to control.

Conclusion

After extensive testing, Dark Algo EA V2.0 proves to be a well-balanced and intelligent trading system. Its strengths include strong performance in trending markets, solid risk management, and advanced filtering that prevents unnecessary trades. Performance may slow during flat or low-volatility conditions, and optimal results require a reliable ECN broker and VPS for fast execution. Overall, Dark Algo EA V2.0 is a stable and disciplined algorithmic trading solution that can be a valuable addition to a diversified trading portfolio.