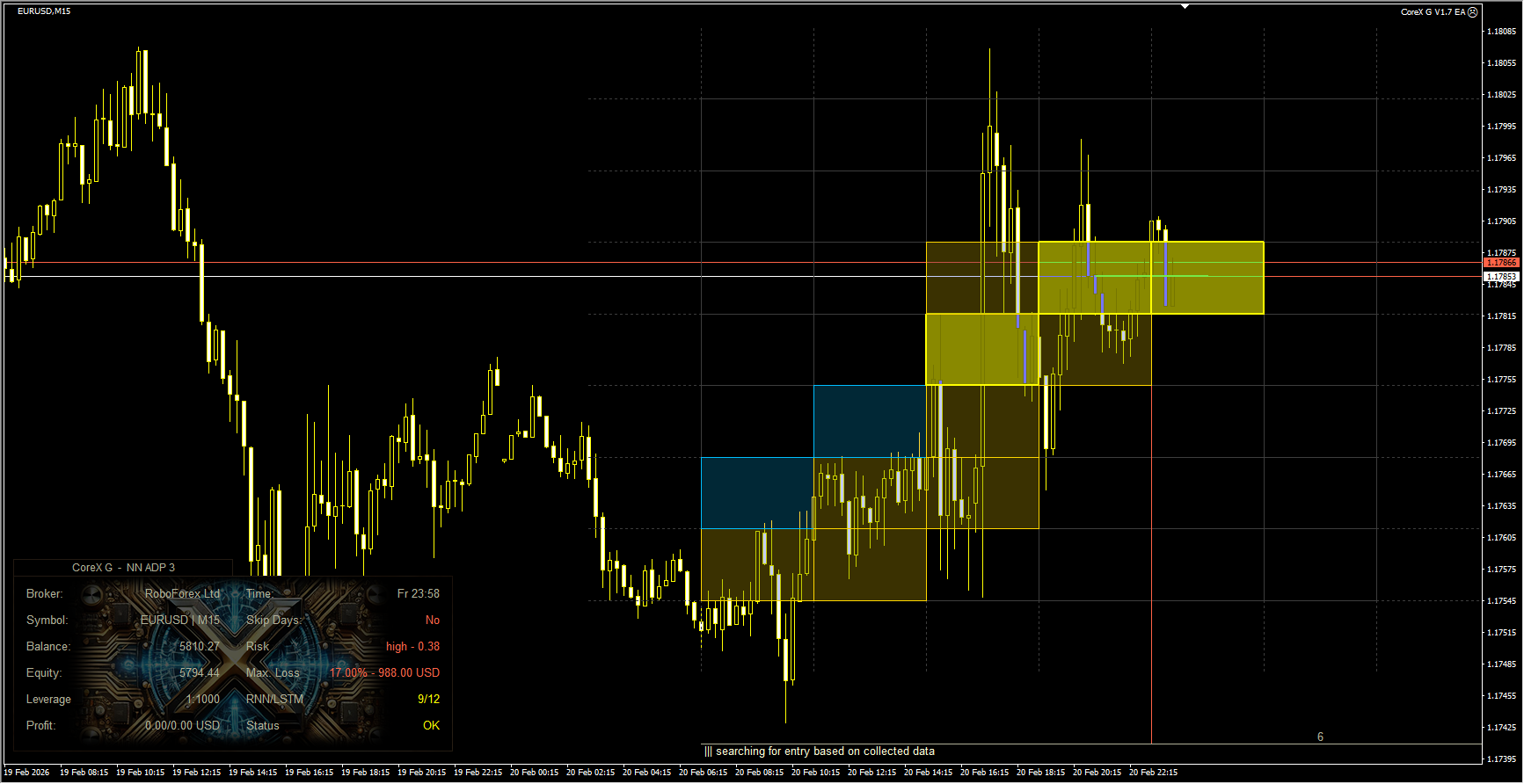

As a trader who tests dozens of automated systems, I was immediately impressed by the sophistication of CoreX G EA V1.7. This expert advisor integrates RNN/LSTM neural network decision-making, adaptive logic, and visual trade zone analysis to identify optimal trading opportunities.

Building on the solid foundation of CoreX G V1.6, version 1.7 introduces enhanced risk management, faster model adaptation, and more accurate zone detection, along with improved stability under volatile market conditions.

From initial testing, it’s clear that CoreX G V1.7 prioritizes quality over frequency. Trades are precise, drawdowns remain modest, and the EA adapts swiftly to shifting market dynamics. Its visual interface allows traders to track the AI’s learning process and understand the logic behind each trade.

Recommended Settings

Currency Pairs: Optimized for XAUUSD

Timeframes: H1 only

Minimum Deposit: $1,000 (optimal $3,000+)

Leverage: 1:100

Account Type: ECN or RAW Spread for fast execution

Key Features of CoreX G EA V1.7

AI core powered by RNN/LSTM neural networks

Smart learning module for continuous adaptation

Visual chart display of trade zones and decision timing

Adjustable risk parameters: max loss %, skip days, trade size

Detailed dashboard with equity, drawdown, and performance metrics

Fully automated system requiring zero manual input

Safety logic to halt trading if drawdown exceeds tolerance

How CoreX G EA V1.7 Works

CoreX G EA leverages deep learning algorithms to anticipate Market Structure shifts. Unlike traditional EAs, it doesn’t rely on lagging indicators or static rules. Instead, it identifies high-probability trading ranges and areas of imbalance (supply/demand zones) using recent price and volume data.

Patterns are plotted directly on the chart with a color-coded zone matrix

Zones dynamically evolve as the market changes

Trades are executed only under optimal conditions, reducing noise and risk

Its logic aligns closely with smart money concepts, powered by adaptive AI rather than fixed rules.

Trading Signals

The EA trades under highly selective conditions:

Buy Entry: Price enters a fresh demand zone, confirmed by volume absorption

Sell Entry: Price reaches a supply zone and shows rejection

Exit: Fixed targets or dynamic zone invalidation based on volume shifts

Risk Control: Stops trading if daily max loss (10–15%) is breached

Patience is key—the EA may wait 10+ hours for high-probability setups, but entries are precise and disciplined.

Pros & Cons

Pros:

Exceptional accuracy on XAUUSD (gold)

Visual zone mapping clarifies trade logic

Consistent equity growth with minimal drawdowns

Built-in risk limits and safety triggers

No martingale, grid, or excessive leverage

Cons:

Focused on XAUUSD only

May remain inactive during extreme volatility

Neural network parameters cannot be manually adjusted

Conclusion

CoreX G EA V1.7 is a refined AI-driven EA for traders who value precision, risk control, and disciplined automation. Ideal for gold trading on H1 charts, it offers stable growth and minimal drawdowns. This EA is not for scalpers—it’s for serious traders who prefer fewer, high-quality trades over frequent signals.